Shipping Reports

Shipping Reports

Monthly Shipping and Marketing Report | August 2023

Council Update

Council Meeting: The next Council meeting will be held on September7 in Kennett Square, PA. If you are interested in attending, please let us know so we can be sure you are accommodated.

Annual Industry Meeting: Wednesday, September 6; 4:30-6:00pm ET,Hilton Garden Inn, Kennett Square, PA

Zoom – sign up here:

Join the Mushroom Council to:

- Review current 2023 performance and outlook

- Preview 2024 marketing/demand development Strategy and Plan

Agenda:

- Welcome: Council Chair Curtis Jurgensmeyer

- Situation Overview: Bart Minor, President, Mushroom Council

- Market Performance, Insights and Strategic Marketing Plan: Anne Marie Roerink*, 212 Analytics (retail and foodservice data & insights)Pam Smith**, Shaping America’s Plate (foodservice)Amy Wood***, Curious Plot (consumer)

- Q&A

*Anne-Marie Roerink is the president of 210 Analytics, a research firm specialized in food retailing. Working closely with growers/shippers, retailers and trade associations, Anne-Marie has developed an excellent perspective on how consumer wants and needs are shaping demand in a one-size-fits-no-one world. She understands the challenges and opportunities in the produce business today as well as the drivers of success tomorrow. She works in many different areas from meat and produce to candy and bakery — uncovering the trends in our ever-changing marketplace

**Pam Smith, RDN, nutritionist, radio host, author, and industry culinary consultant provides strategic menu innovation and insight to top hotels and restaurants across the country. She is the co-creator of Darden Restaurant’s Bahama Breeze and Seasons 52 restaurants, is the Chair of the Culinary Institute of America’s Healthy Menus R&D Collaborative and has hosted and emceed all 24 years of Disney’s Epcot International Food and Wine Festival. She is Founding Principle of Shaping America’s Plate, Inc., authored 17 books on health and wellness and brings foodservice thought leadership, and activations to the Mushroom Council.

***Amy Wood, Senior Vice President at Curious Plot, has spent the past two decades working in food and agriculture, developing innovative marketing campaigns and strategic partnerships. For the past 8 years, she’s overseen strategy and planning for the Mushroom Council’s consumer initiatives, including directing the Council’s media relations, social/digital outreach, and partnerships with the James Beard Foundation, Bon Appetit, Buzzfeed, Blue

Recently Approved Materials

- Specialty Mushroom Trends in Foodservice

- Understanding the Why Behind Fresh Mushroom Volume Pressure

- Produce for Better Health Influencer Toolkit Summer 2023

- Foodservice Recipes: Mushrooms in the Plant-forward Kitchen

- Recipe of the Month: Aug 2023 – Meaty Mains Made Meatless

- Blog Post: August 2023 – The secret to plant-based seafood

- Mushrooms in the News:

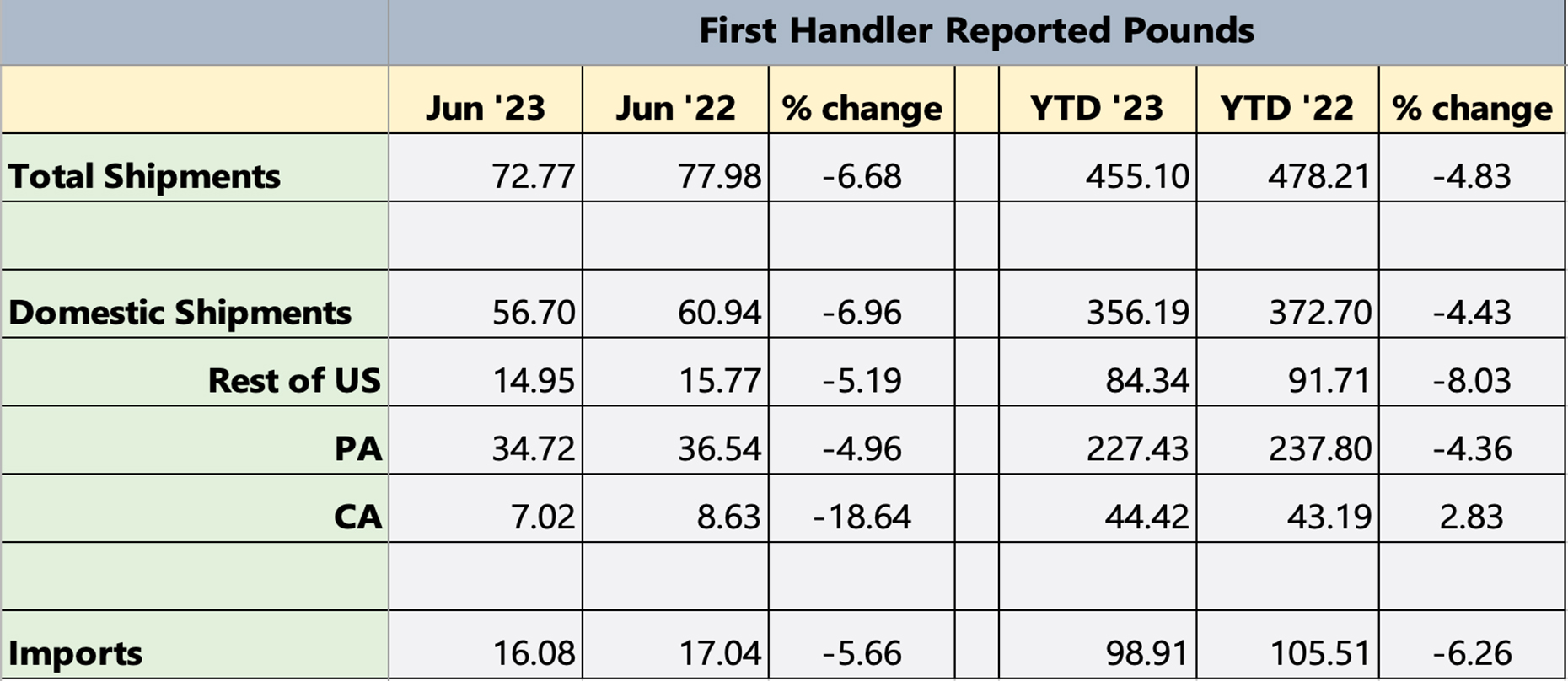

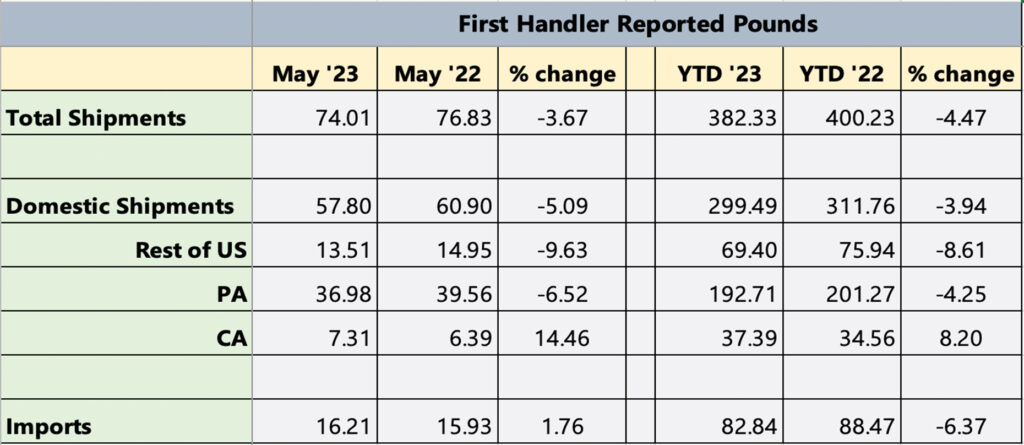

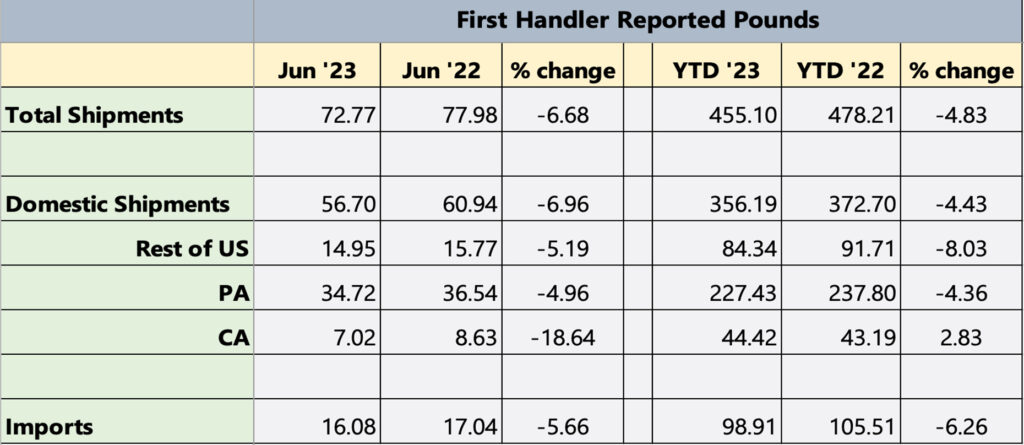

Shipment Summary

Channel Highlights

RETAIL

July:

- The Root Cause: A Fresh Mushroom Sales Volume Deep Dive report compiles numerous data points to provide our industry with a detailed look at volume pressure in fresh mushroom sales and the root causes behind it. The report contextualizes today’s fresh mushroom data with comparisons to total produce, pre-Covid and year-over-year volume, and much more. Download the report here.

FOODSERVICE

August:

- Colleges & Universities Good Food Culinary Day, Yale University, on August 10, 2023.

- The Mushroom Council’s Chef Partners, Pam Smith and Andrew Hunter will be leading the event and engaging the Dining Directors from Harvard, Princeton, Cornell, Boston University, MIT, University of Maryland and other northeast C & U culinary professionals.

- This one-day menu innovation program includes a Datassential presentation on the latest culinary trends and research centered around college students, live cooking demonstrations from our culinary experts, and hands-on kitchen sessions, creating new high flavor dishes.

- Experience it all with us on LinkedIn and Instagram!

- Flavor Experience, San Diego, August 20-22, 2023

- Pam Smith, our Foodservice Strategist, will be presenting on Transformative Innovation, and leading 2 Innovation Townhalls at The Flavor Experience. Brought to you by Flavor & The Menu magazine, The Flavor Experience inspires high-volume food & beverage menu developers with trend-forward ideas and experiences.

- We are doing a Tasting Toolbox on Mushroom “Bacon” – and personally serving up Blended Cremini and Chicken Meatballs on a Grains and Greens Bowl, “Port” Tenders with Miso Aioli, Portobello Shakshuka and a Peruvian Mushroom Lomo Salted over Cremini Potato Cakes.

- Experience it all with us on LinkedIn and Instagram!

- MISE, Atlanta, August 26-29, 2023

- The Mushroom Council is leading a Lunch and Learn on the Blend and Extending the Blend 2.0 at Mise.

- The event is a perfect opportunity to get Mushrooms up close and personal with Culinary Leaders from Hotels, Resorts, Theme Parks and Cruiselines. This segment has a quick around — they see a new idea today and can menu it next month!

- Experience it all with us on LinkedIn and Instagram!

MUSHROOMS IN SCHOOLS

August:

- In August, Mushrooms in Schools will be discussing school breakfast ideas and recipes! This will be timely as schools start their school year. Last spring, USDA released proposed rules that will enhance school breakfast regulations, which will go into effect soon. Our giveaways for schools and CACFP will occur to increase engagement from these stakeholders as well as gathering wonderful mushrooms recipes. We encourage other channels to amplify Mushrooms in Schools by sharing posts on Facebook and Twitter.

July:

- During July, Mushrooms in Schools traveled to ANC to meet with Food Service Directors across the country! We made great connections, and our feature promotion – Portable Portabella Burger – was announced wide and far. As a fun, trendy conversation – we took our promotions and put a #TSErasTour spin. We highlighted resources, recipes, and giveaways around this promotion.

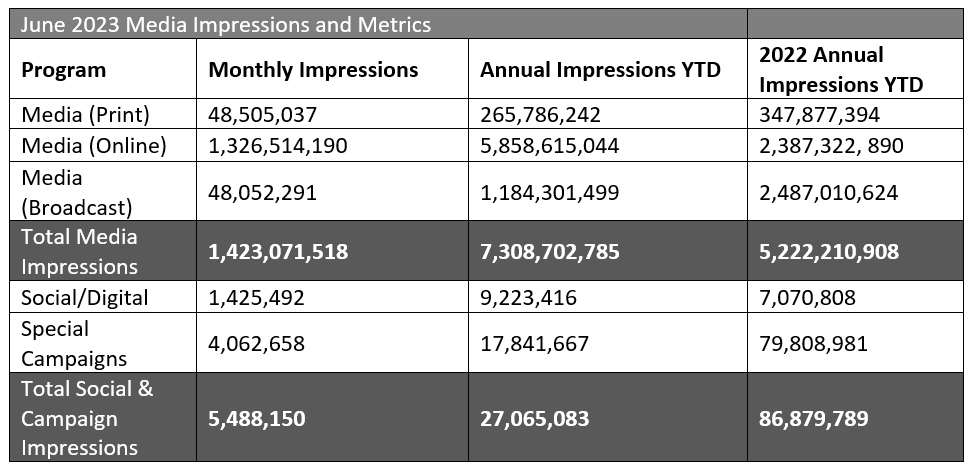

Marketing Summary

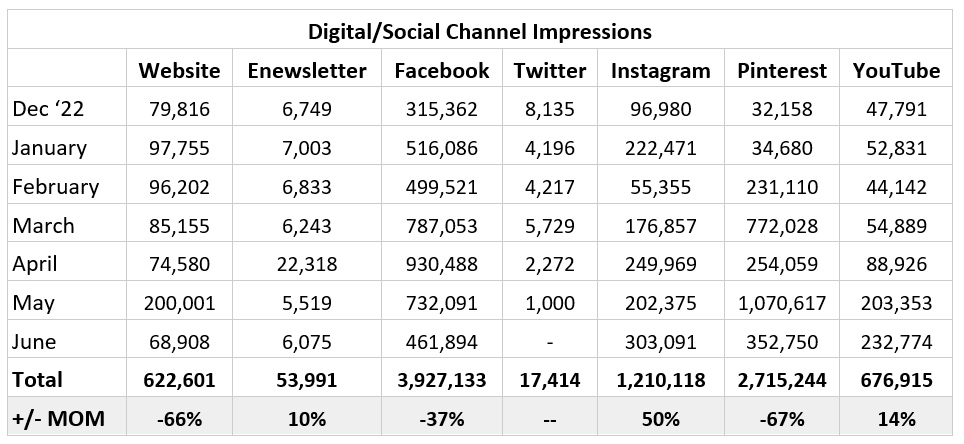

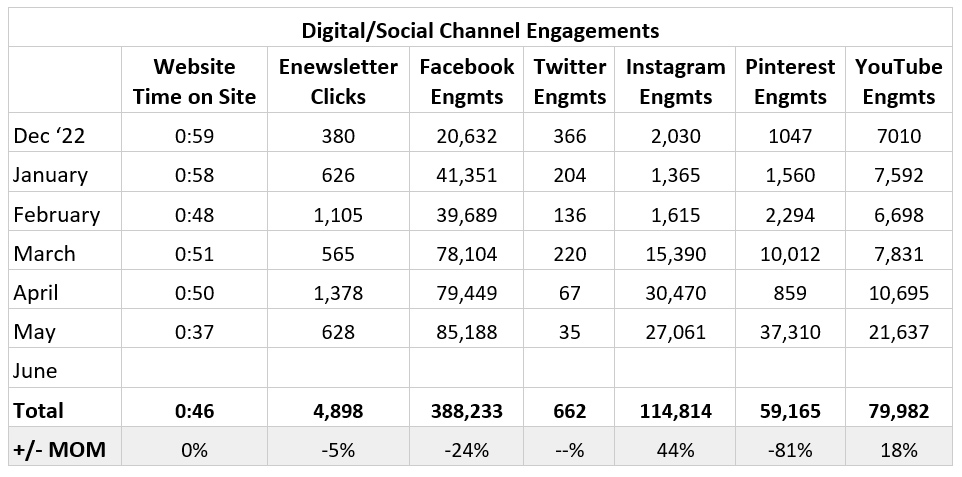

Notable Highlights for June

- Programmatic continues to perform well as a driver of quality traffic to the website. CTR (0.18%) continues to be outstanding for this channel, besting the industry benchmark of 0.07%.

- Visitors who have come to the Mushroom Council landing pages from our ads had an engagement rate of 8.2%, which is a top performer.

- We had 4.97 events per session from users who came to the website from our programmatic ads, which is higher than organic search. This shows that our audiences are finding the ads engaging, and willing to continue their customer journey.

- We did not have as many ads driving traffic in June as we have in previous months, so we did see a dip in traffic to the website in June. Spend was down this June on Instagram in comparison to last June, but our engagements were up 350%.

- We continue to see high performing static posts in June.

- We continued to run the “Add to Cart” ad campaign on Pinterest throughout the first half of June. Our pin click through rate was good at 1.29%, but the click through to the website was only 0.35% (total 577 people to the site).

| *Youtube engagement metrics have changed. Digital metrics are constantly evolving, so we created our own updated Engagement metrics (comments + shares + likes + dislikes + subscribers lost + subscribers gained) |

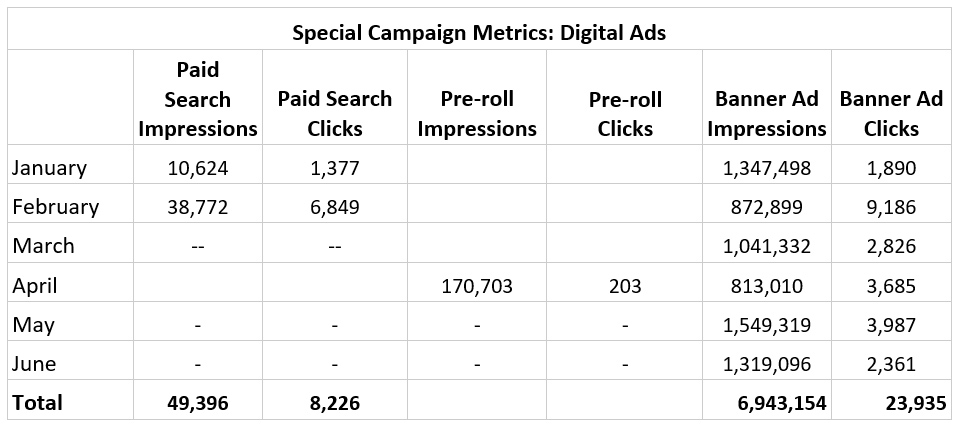

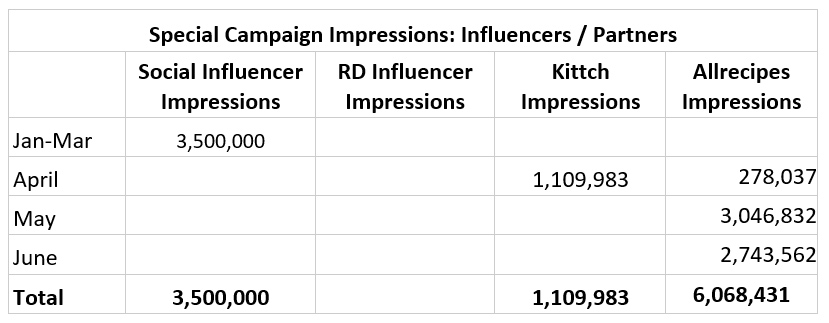

Special Campaign Impressions

Includes paid promotions, partnerships and advertising activities.

Previous Month’s Highlights

January

- The relaunch of this year’s FYIS campaign resulted in an influx of impressions and engagements across social channels, in particular Facebook (+64% increase in Impressions and 100% increase in Engagements).

- The FYIS kick-off eblast also prompted hundreds more clicks than the month prior, driving users to the FYIS landing page.

- While social impressions and engagements are tracking YOY, digital ad impressions are down compared to January 2022. This could be due to a lower ad budget this year, ad fatigue (3rd year running) and/or audience targeting changes. We are testing and evaluating ad updates to optimize and maximize our impact through the rest of the campaign.

February

- Overall impressions from the MC social channels dipped compared to last month but remain consistent with results YOY.

- We shifted budget from Instagram and Facebook to Pinterest, which is reflected in the dramatic increase in engagements and impressions.

- Due to the inclusion of the “Feed Your Immune System with Soup” giveaway in the e-newsletter, we saw a 77% increase in clicks. 28% of the total clicks were to the Facebook post, followed by the FYIS Exclusive Recipe Card Download.

- Pinterest impressions and engagements also saw an incredible spike due to reallocation of paid spend on this channel.

- Digital ad results are up from January, but continue to underperform compared to 2021 due to an increase in cost per impression and competition. We’re continuing to test and evaluate updates to help optimize throughout the rest of the campaign – and future campaigns.

March

- While overall Impressions and Engagements remain steady/positive for for MC social channels, we are continuing to see numbers down from last year’s digital ads, which were a huge contributor to Impressions and Clicks to the website. Despite shifts in budget, targeting and creative, we were unable to meet the same impressions we saw last year.

- This is likely contributed to increasing competition: The PPC (Pay Per Click) advertising landscape has become increasingly competitive as more businesses continue to shift/invest in digital ads.

- As we move into new campaigns, we’ll continue to test and optimize digital ads to better understand whether to continue or shift budgets to better performing tactics.

- Despite the decline in digital ads YOY, we are seeing tremendous performance on owned social platforms, specifically Pinterest and Instagram Impressions and Engagements, due to paid spend allocations.

April:

- Although we had a decrease in ad spend on Instagram from last year, we saw an increase of engagements on our posts. One large driver of engagements in April was the post asking users to pick their favorite recipe. This led to 77 comments, 28 shares, 126 saves and 388 likes which were primarily organic.

- On Pinterest our traffic to our website is up significantly from last year. We are going to continue to push this platform and look for ways to optimize our creative and copy to perform even better.

- With the increase to weekly eblast this month, we saw a dramatic increase in enewsletter opens and clicks.

- To note, we are shifting efforts away from Twitter with plans to monitor for questions only in the future. Expect to see drops in results on that channel as a result.

- We ran three different digital ad strategies this month targeting Home Chefs for Earth Month:

- Prospecting: Display (banner ads pointing to MC Earth Month landing page)

- Prospecting: Kittch (banner ads pointing to Kittch streams)

- Prospecting: Pre-Roll (pre-roll ad pointing to Kittch streams)

- Despite lower impressions from last year, the CTR on our digital ads is outstanding, besting the industry benchmark of 0.07%. TheCTR for MC digital ads for this month was .4%, an increase of 35% compared to the previous month.

- Pre-Roll performed great from a brand awareness standpoint, as 87,875 users watched the video in full.

May:

- Programmatic ads continue to perform well as a driver of quality traffic to the website.

- CTR continues to be outstanding for this channel at .84%, besting the industry benchmark of 0.07%.

- Website traffic increased considerably from last month, +168%.

- Facebook Paid Impressions are up and Organic impressions are down. This also shows us how important paid is in social, as year over year we see less organic engagement on posts.

- With incredible organic success on Pinterest, we are putting more efforts there, both organic and paid, hence the 321% increase in impressions and 4000%+ in engagements.

- Special Campaign and Overall Impressions are down from 2022, for several reasons, including a shift away from influencer partners, a shift from Food Network to Allrecipes (different campaigns and tracking), and the competitive digital ad landscape.

- To note, we are shifting efforts away from Twitter with plans to monitor for questions only in the future. Expect to see drops in results on that channel as a result.

Topline Report

Tracker Highlights – Period ending 07/16/2023

- Download Retail Tracker for Period ending 07/16/2023

- Download Fresh Mushroom Sales Review for Period ending 07/16/2023

- Download Mushroom Retail Performance for Period ending 07/16/2023

The Markeplace

Special occasions and celebrations are the number one reason for consumers to splurge a little. This resulted in noticeable sales spikes for many departments during the holiday weeks leading up to Memorial Day and the Fourth of July. During regular weeks, the consumer focus remains on saving money by buying less. Per Circana:

- While the rate of inflation has moderated in the past three months, 86% of consumers still perceive grocery prices as much higher (59%) or somewhat higher (27%) when compared to last year.

- The sustained increases in prices of groceries and beyond have 93% of consumers concerned.

- In response, 82% continue to make changes to what, how much, which brand and where they are shopping for groceries. Money-saving measures continue to be focused on capitalizing on sales promotions (51%) and cutting back on non-essentials (45%). One-third also looks for coupons more often.

- Outside of in-store signage, the grocery store app has become the number one way in which shoppers research promotions, followed by the printed circular (29%) and emails (27%).

- Sales specials are increasingly driving the meal lineup: 36% check what is on sales before making the shopping list and 27% check deals across more than one retailer.

- For the four weeks ending July 16th 2023, total food and beverage dollar sales increased 3.7% over the quad-week period, but units were down 2.0%.

Dollars, Units and Volume Performance

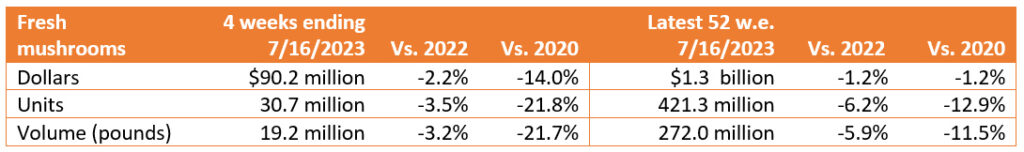

Fruit inflation increased once more after several months of deflation. Vegetable prices continued to rise though at a slower rate. When regarding the latest 52 weeks, inflation boosted dollar sales by 3.2% but units and volume trailed behind the year-ago levels, at -1.0% and -1.9%, respectively. Fresh mushrooms experienced unit and volume declines during the shorter and longer time periods. In the latest four weeks, volume declines stayed around 3 points of year ago levels. Importantly, volume declines are moderating in comparison with the 52-week look that shows pounds down 5.9%.

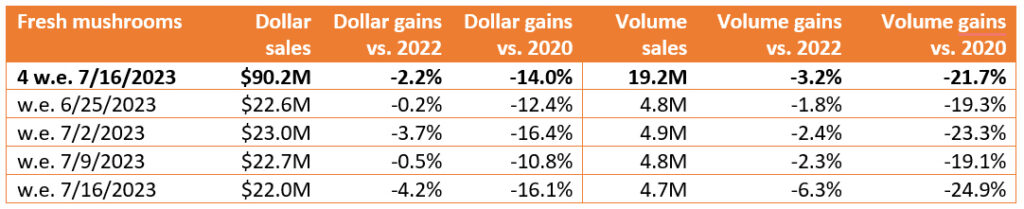

Weekly sales for mushrooms averaged between $22.0 million and $23.0 million in each of the four weeks. Sales were slightly higher the week of July Fourth — demonstrating that special occasions and holidays still drive slightly higher spending across categories, including mushrooms. The period-over-period sales trends continue to follow long-established patterns (as seen on the forecasting tab). During the summer months, sales tend to decrease quad week over quad-week period, and pounds start to gear back up after the back-to-school season.

Inflation

Inflation in vegetables is moderating and mushrooms are following suit. Mushroom prices per unit increased by 1.4% versus year ago in the latest quad-week period. This is down from 5.3% in the 52-week view.

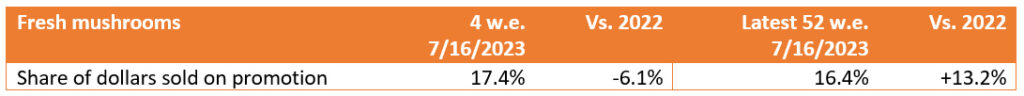

Moderation in price increases went hand-in-hand with an increase in promotional activity in the 52-week view. During the latest quad-week period 17.4% of total fresh mushroom dollars sold while on promotion, which was down about 6%.

Performance by segment

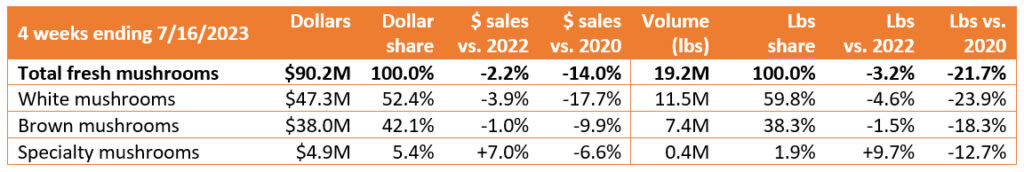

White mushrooms represented 52.4% of mushroom dollars and 59.8% of pounds in the four-week period. Brown mushrooms, the combination of criminis and portabellas, fared better than white mushrooms, with flat dollar sales versus year ago levels in both dollars and pounds. Pounds and dollars continue to shift toward brown mushrooms.

Additional observations:

- Package size: 8-ounce packages generated 52.7% of total sales in the four-week period, but dollar sales declined 3.2% versus the same four weeks in 2022. 16-ounce packages represented 18.6% of sales and declined 4.4% in dollars.

- Organic vs. conventional: For total produce, organic sales are underperforming in comparison to conventional. Mushrooms are the opposite. Organic mushrooms made up 10.5% of pounds and have been an above-average performer for months. Over the past 52 weeks, dollar sales increased 2.3% for organic mushrooms versus a 1.7% decline for conventional. Organic also grew units and volume over the past four and 13 weeks.

IRI, Integrated Fresh, MULO, YTD and 4 or weeks ending 07/16/2023

We collect, use and process your data according to our Privacy Policy.