Shipping Reports

Shipping Reports

Monthly Shipping and Marketing Report | March 2022

Council Update

Exemption Applications: The exemption applications for the 2022 calendar year will be mailed to those who are currently exempt. If you do not receive an application and would like to apply for an exemption, please email [email protected].

Next Council meeting – June 9-10, 2022 – Los Angeles, CA

Open Positions on the Council (2023-2025 term):

A call for nominations will be sent on or about February 1, 2022, for three open positions on the Council for the 2023-2025 term.

- Region 1 (All states except CA & PA) – two open positions

- Region 2 (PA) – one open position

Mushroom growers have ideas, skills, experiences and perspectives that would benefit the industry; be a voice for your industry by becoming part of the Council.

The U.S. Department of Agriculture and the Mushroom Council encourages all eligible producers, including women, minorities, and individuals with disabilities to participate and seek the nomination.

2022 Council Members:

- Region 1: All states except CA & PA

- Curtis Jurgensmeyer – J-M Farms – OK – 2nd Term ends 2023 – Chairperson

- Fletcher Street – Ostrom Mushroom Farms, WA – 1st Term ends 2022

- Ed Wuensch – Kitchen Pride Mushroom Farms – TX – 1st Term ends 2022 – Treasurer

- Region 2: PA

- Michael Basciani, Sr. – M.D. Basciani Mushrooms – PA – 1st Term ends 2024

- Joe Caldwell – Giorgi Mushroom Company – PA – 2nd Term ends 2023

- Meghan Klotzbach – C.P. Yeatman & Sons – PA – 2nd Term ends 2024 – Secretary

- Mark Moran – Kaolin Mushrooms – PA – 1st Term ends 2022 – V. Chair

- Region 3: CA

- Jack Guan – California Terra Garden – CA – 1st Term ends 2024

- Region 4: Imports

- Jane Rhyno – Highline Mushrooms – ON – 2nd Term ends 2023

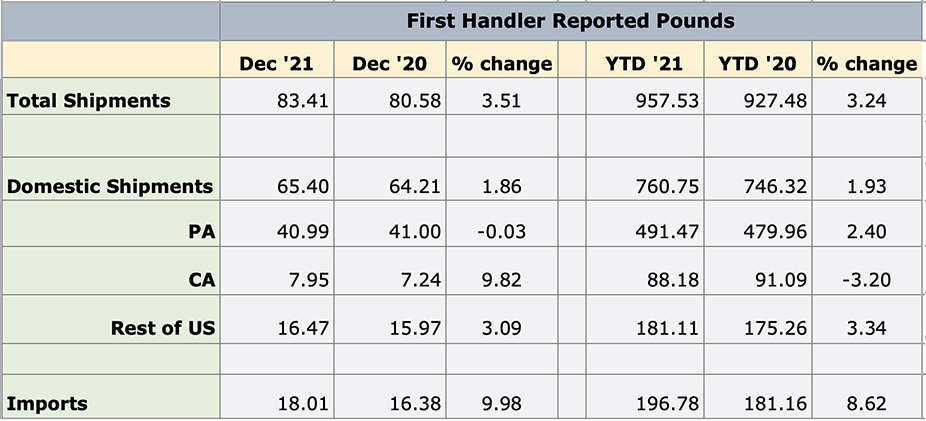

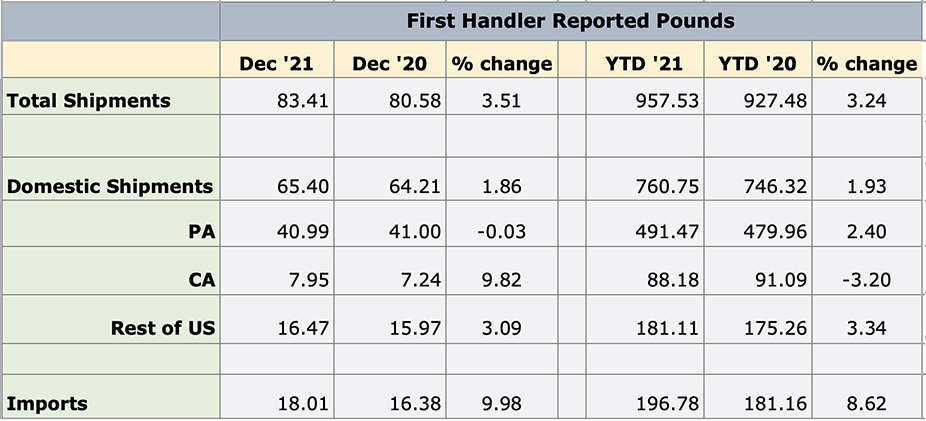

Shipment Summary

To see current charts, click here.

The Month Ahead

PUBLIC RELATIONS & DIGITAL

- Mushroom Council will continue preparation for April activations with both Produce for Better Health Foundation and the RDBA Virtual Experience, partnering with Cara Harbstreet, R.D.

SCHOOL NUTRITION

- In March, Mushrooms in Schools will be supporting National School Breakfast Week (March 7-11). This will include social media highlights of our resources, recipes, and Mushroom Character Superhero. Additionally, we will be sharing resources around the Child and Adult Care Food Program (CACFP). You can support Mushrooms in Schools by following our Twitter and Facebook accounts and elevating our social posts.

Highlights from February

PUBLIC RELATIONS & DIGITAL

- The Mushroom Council continued their Feed Your Immune System program for 2022.

- The Mushroom Council worked with Martha Stewart Living to publish a few articles detailing the culinary and health benefits of a few varieties of mushrooms.

- The Mushroom Council partnered with Kikkoman for some co-branded recipes that will be shared on the Mushroom Council’s website.

SCHOOL NUTRITION

- Mushrooms in Schools hosted a virtual training for Murtaugh School District’s school nutrition professionals in Idaho. This was part of our 12 Days of Mushrooms campaign. Additionally, we highlighted healthy cooking techniques via our blog and social media. February was a great month for school districts to post their amazing #RealSchoolFood recipes with mushrooms. We highlighted their success by sharing on social media. To amplify the hard work school nutrition professionals are doing, please share and like the following posts: Mushroom & Swiss Burger, Philly Cheesesteak Sandwich, National Pizza Day, Beef Stroganoff, and Seared Mushrooms.

Sales Materials

SCHOOL NUTRITION

- Mushrooms in Schools has uploaded new introduction videos for school foodservice directors and managers. These videos can be found here. Please share on your own social channels and encourage your sales teams to share with your school foodservice clients and contacts.

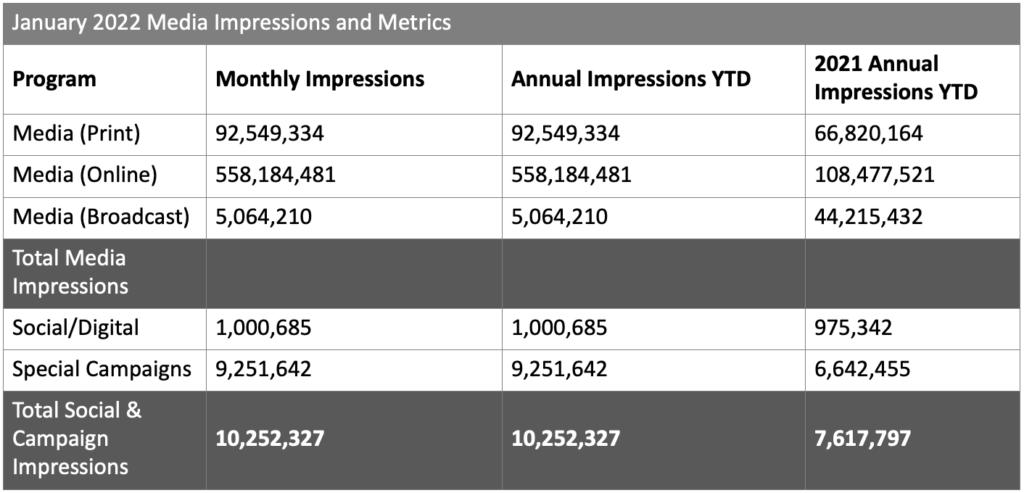

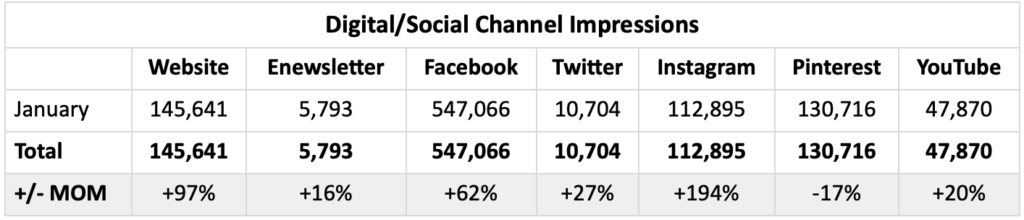

Metrics

Notable Impressions Highlights:

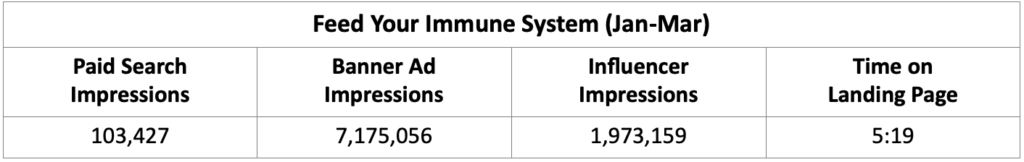

- January: Feed Your Immune System

- The revamped “Feed Your Immune System” campaign kicked off in January, leading to an increase in social impressions across nearly all channels.

- New digital banner ads in January contributed to 7M impressions – helping to surpass January 2021 impressions.

- Influencer impressions decreased from 2021 with a stronger focus on engagements (views, clicks) as video becomes a primary way to reach audiences with our messages. Noteably: Engagements nearly doubled and clicks to site more than tripled.

- Instagram Reels and new animations helped to increase Instagram impressions by nearly 200%, while the website also saw a dramatic increase in page views due to the campaign landing page traffic.

- The FeedYourImmuneSystem.com landing page received nearly 60k pageviews in January – a 411% increase from 2021.

- While the average time on the page is less than last year (8 min), it is still a very respectful 5 min. and 19 sec.

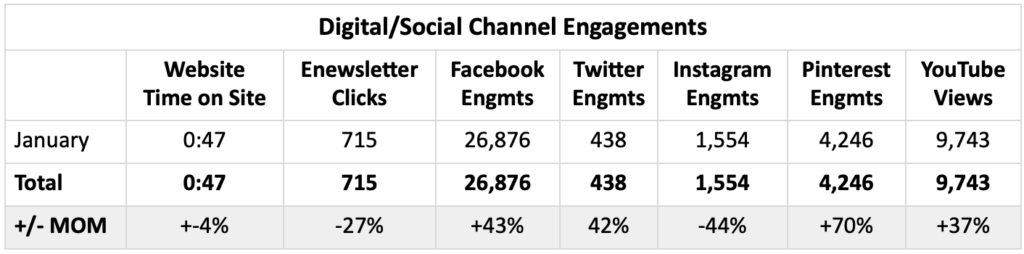

Notable Engagement Highlights:

- In July, YouTube views increased considerably due to the pre-roll video ad (“Value of The Blend”) showcasing how The Blend can he

- In September we saw increases in enewsletter clicks and social engagements were due to our Mushroom Month promotions (weekly enewsletters and daily social interactions).

Special Campaign Impressions

Includes paid promotions, partnerships and advertising activities.

Monthly Topline Report

Tracker Highlights – Period ending 01/23/2022

- Download January 2022 Retail Tracker

- Download January 2022 Fresh Mushroom Review

- Download January 2022 Mushroom Performance

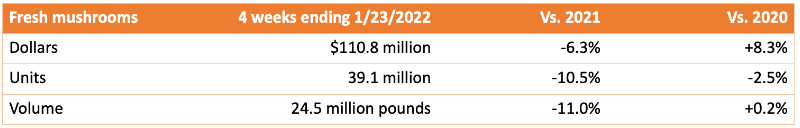

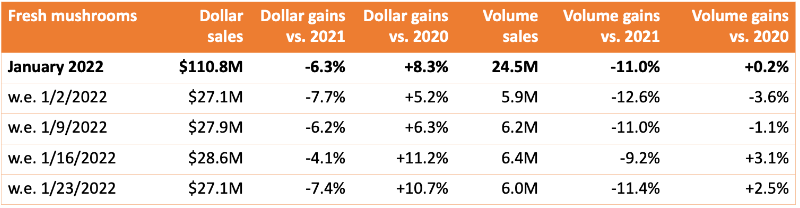

Dollars, Units and Volume Performance

- High inflation boosted produce dollars in the first four weeks of 2022, but volume pressures persisted. The total produce department reached $5.3 billion in the four weeks ending January 23, 2022, which was up 4.0% over the comparable period last year and up 15.4% versus 2019. However, units (transactions) were down 4.6% and volume (pounds) decreased by 4.5% year-on-year. For virtually all areas in produce, today’s performance story is determined by the three-way combination of the level of inflation, market disruption and the sales results in the first pandemic year. Many produce items, mushrooms included, are not lacking from consumer demand but rather the supply chain is struggling to meet the demand. Additionally, the greater the early pandemic spikes, the harder the road to continued growth. Fresh mushrooms trended in the top 10 produce categories with absolute dollar growth for 52 straight weeks, creating a tough path for continued gains, especially in the light of limited supply.

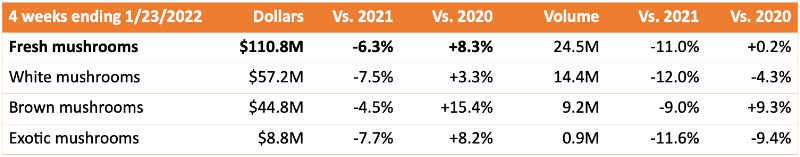

- For the first four weeks of January, fresh mushroom dollars decreased 8.3% year-over year and volume declined by 11%. However, January 2021 fresh mushrooms dollar sales exceeded the pre-pandemic levels of the first four weeks of 2020 by 8.3% and volume by 0.2%. This illustrates that demand is really on par with normal levels. A shift has taken place to larger package sizes, illustrated by units being down by 2.5% but volume being up 0.2%.

- Fresh mushroom sales were highest during the final week of the year, reaching $31.9 million. This was up 0.7% versus year-ago levels. Three out of the four weeks also gained versus their December 2019 totals. The only week that did not was the week before the holiday, ending December 19.

Inflation

- The total produce performance was heavily impacted by inflation in January 2022. Produce prices increased 9.0% during the four weeks ending January 23rd on a per unit and per pound basis. Fruit had the higher inflation but even vegetables increased to an average of $1.89 per pound, up 4.8% versus year ago.

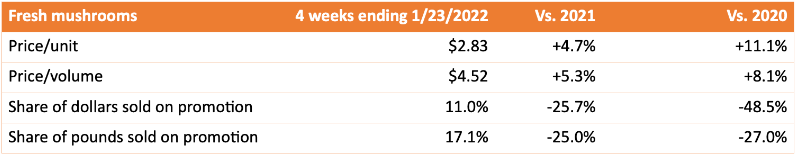

- The increases in the price per unit and the price per pound for mushrooms during this same time period were far below average. The average price per volume for fresh mushrooms increased 5.3% during the first four weeks of 2022 versus the same period in 2021, to an average of $4.52. While inflation is below average, that does make mushroom a higher ring item than many other produce items on both a per unit and per volume basis. The unit price increase was similar, at +4.7% to an average of $2.83. Fresh mushroom dollar and pounds were much less promoted. Down by about one-third, only 11.0% of January mushroom dollars happened while on promotion.

Performance by segment

- White mushrooms represent 51.7% of total fresh mushroom sales and 58.6% of pounds in the four January weeks. However, it was brown mushrooms, the combination of creminis and portabellas, that fared better. Brown mushrooms increased 15.4% in dollar sales versus the pre-pandemic January 2020 weeks and 9.3% in volume. As such, brown mushrooms were solely responsible for driving volume gains versus January 2020.

Additional observations:

- Fixed versus random weight performance: The vast majority of fresh mushroom dollars (95.5%) and pounds (96.1%) were fixed weight in the four January weeks. Just like in fresh produce overall, fixed weight (-4.9% in dollars) performed better than random weight (-18.5%).

- Organic versus conventional: Organic dollar sales made up 13.5% of total fresh mushroom sales in the four January 2022 weeks. Organic mushrooms had a slightly better performance than conventional mushrooms, at +2.4% year-on-year versus -6.7% for conventional.

- Cut/prepared versus whole mushrooms: Cut or prepared mushrooms made up 53.3% of dollar sales in the four January 2022 weeks. Mushrooms without preparation had the better performance. Cut/prepared mushrooms were down 7.5% in dollars and 11.3% in volume. Whole mushrooms were down 3.2% in dollars and 9.3% in volume.

IRI, Integrated Fresh, MULO, 52 weeks ending 01/23/2022

We collect, use and process your data according to our Privacy Policy.