Shipping Reports

Shipping Reports

Monthly Shipping and Marketing Report | October 2023

Council Update

Council Meeting: The next Council meeting will be held on February 27 in Las Vegas prior to the North American Mushroom Conference. If you are interested in attending, please let us know so we can be sure you are accommodated.

Council Webinars: See past webinars here: MushroomCouncil Industry Member Webinars

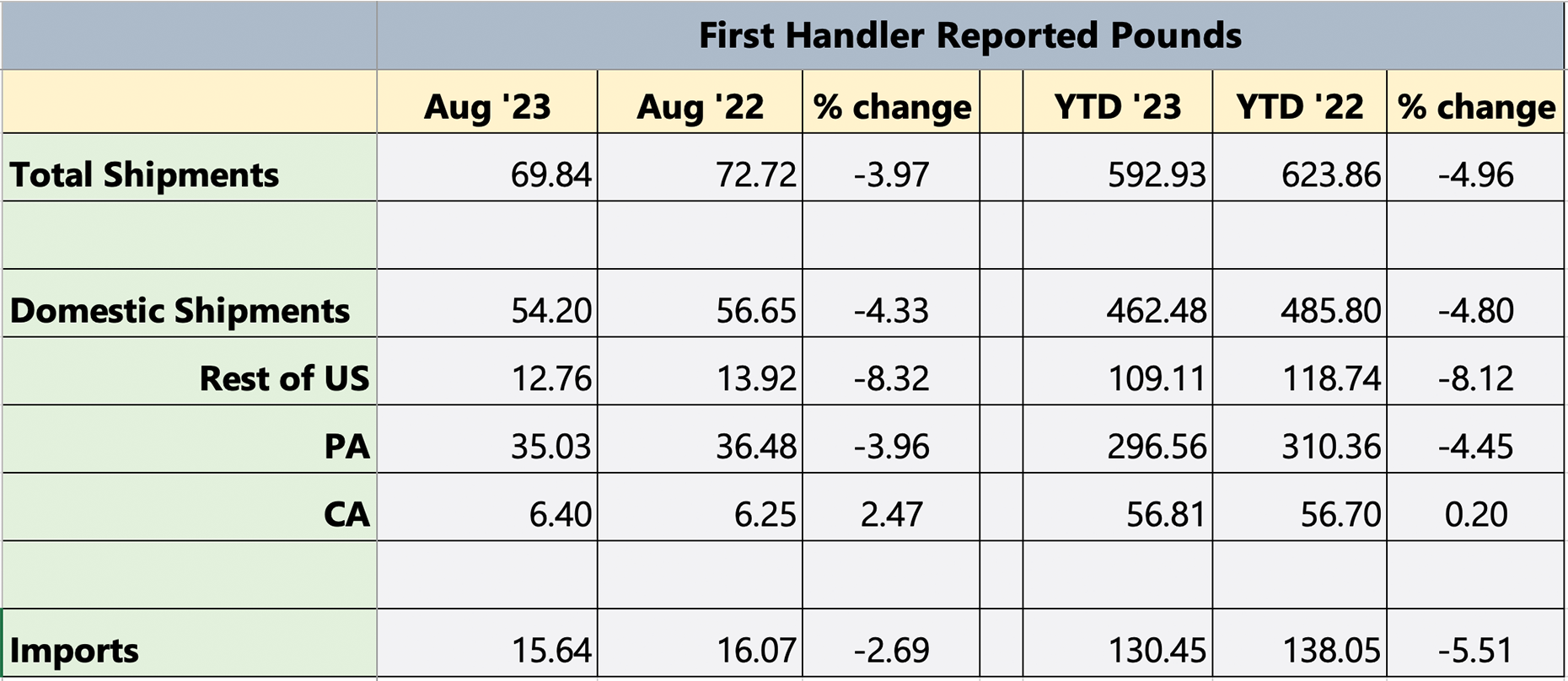

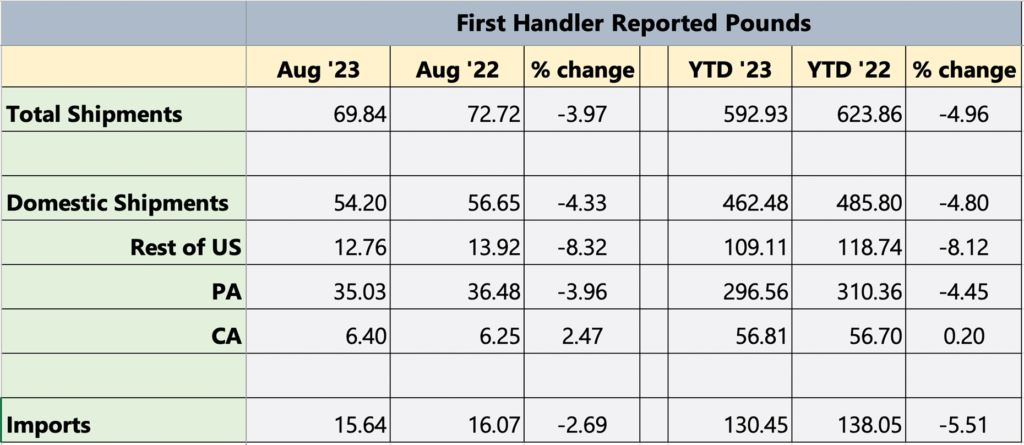

Shipment Summary

Channel Highlights

CONSUMER

October:

- The Mushroom Council partnered with renowned chef Derek Sarno for a Mushroom Grilling 101 campaign. Chef Sarno has developed 4 recipes that will debut via e-blasts, alongside social media posts and reels. Please continue to amplify these social posts across your platforms.

September:

- September was National Mushroom Month: The Mushroom Council debuted a new campaign called “Real Fast. Real Food.” which included a slew of quick mushroom recipes, shared via meal plans for each week in September. The campaign came to life via social media, e-newsletters, blogs and a microsite.

- You can continue to share this evergreen content on your social channels using pre-designed social graphics. You also have access to downloadable meal plans, recipe videos and recipe images that you can share with your marketing and sales teams.

MUSHROOMS IN SCHOOLS

October:

- In October, Mushrooms in Schools will be celebrating Farm to School Month! Additionally, we plan to use October to reach more of our audience, such as CACFP and families, and engage them with agriculture. We will highlight resources and recipes all month long. Our giveaways for schools and CACFP will occur to increase engagement from these stakeholders as well as gathering wonderful mushrooms recipes. We encourage other channels to amplify Mushrooms in Schools by sharing posts on Facebook and Twitter.

September:

- During September, Mushrooms in Schools promoted Mushroom Month by highlighting recipes and resources to engage students. Utilizing our newsletter, blog, and social media platforms, we have reached a wide audience this month – and hope to have encouraged school districts to use our resources for Farm to School Month (October). Many school districts are sharing mushroom recipes and tagging our social media platforms on their posts. On our social media platforms, we highlighted the following school districts: Bristol City School Food Service in TN, HUSD Child Nutrition Services, Queen Creek Unified School District in AZ, Poudre School District Child Nutrition Department, Ashwaubenon Food Service, Garland ISD Student Nutrition, Littleton Public Schools Food Service, Tullahoma City Schools, Millard Public Schools Food Service, SWSD Food Service, and Lee’s Summit R7 Nutrition Services.

NUTRITION RESEARCH

October:

- Katherine Phillips, Virginia Tech bioactive analysis for inclusion in FoodData Central

- Glutathione results to be included in October release of FoodDataCentral

September:

- Wayne Campbell Purdue – Health promotion of mushrooms

- Results from the study on after meal responses for glucose, insulin, triglycerides, and ergo ready for publication. While the Brain health questionnaires from the 8 week clinical trial/addition of mushrooms to Mediterranean style diet analyzed and manuscript drafted.

- Claire Williams/Barbara Shukitt-Hale Univ. of Reading and Tufts University. Oyster mushrooms and cognition; lions’ mane short term dose response:

- A randomised controlled trial to investigate the cognitive, mood and metabolic effects of acute oyster mushroom intervention in older adults poster presented Sept. 18-21 during the Food Bioactives & Health Conference in Prague.

- We will continue the review of mushrooms and cognition through the lifespan manuscript in final revisions. As well as, Biomarker analyses of serum from the short term dose response oyster trial pending.

- Submitted comments on behalf of the Council in response to the proposed Dietary Guidance Statements in Food Labeling stating that regular consumption of mushrooms as a nutritious choice in healthy dietary patterns are consistent with the intent of the draft guidelines.

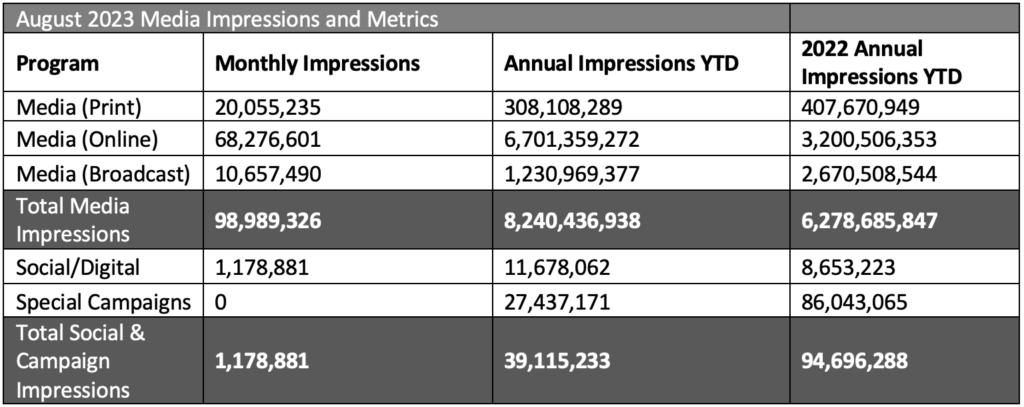

Marketing Summary

Notable Highlights for August

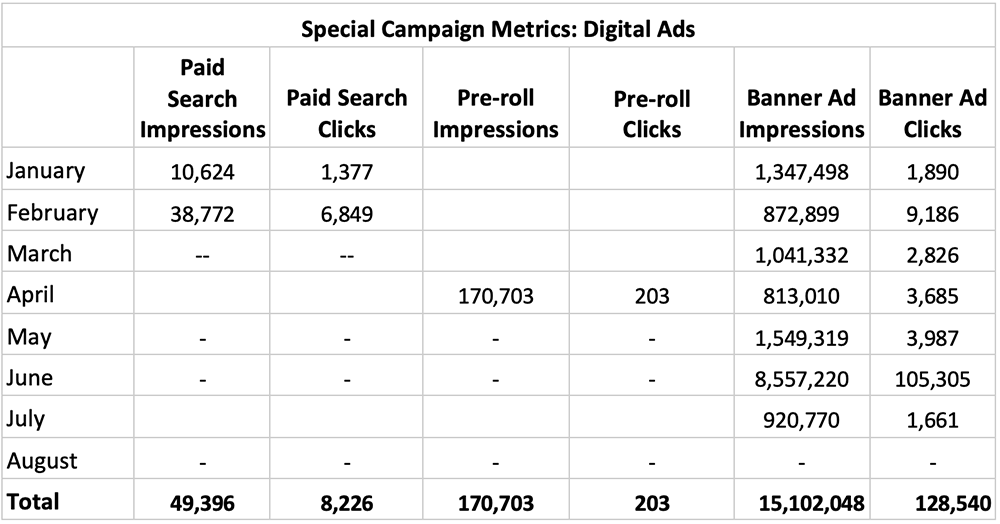

- With The Allrecipes campaign wrapping in July and the National Mushroom Month campaign ready to launch in September, we did not have any digital ads or special campaigns running during the month of August.

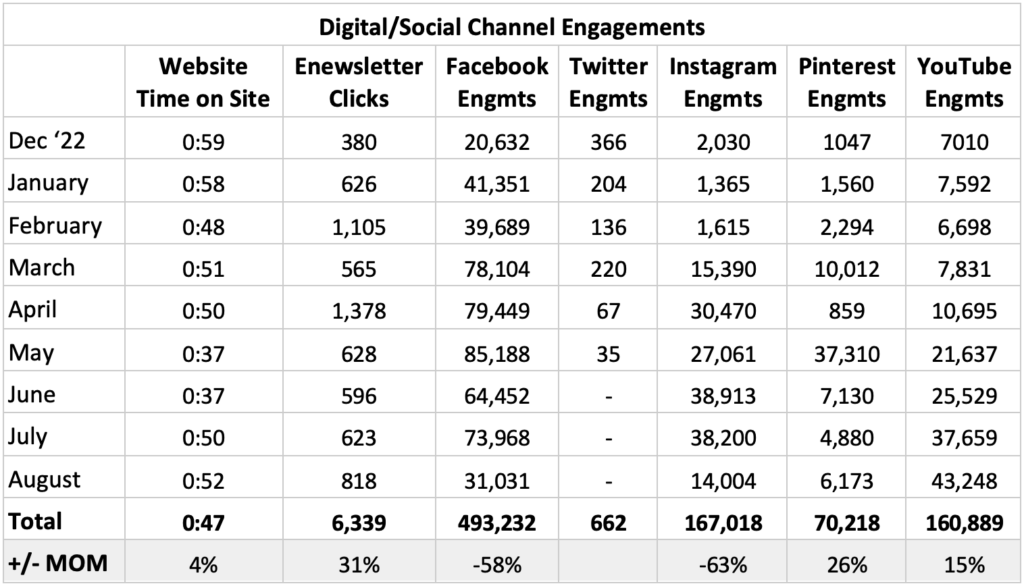

- Despite a slight decrease in social ad spend this month, traffic to the website from social channels increased from July. Recipe posts remain key drivers of traffic, with some of the best-performing posts coming in at only $0.07 cost per click.

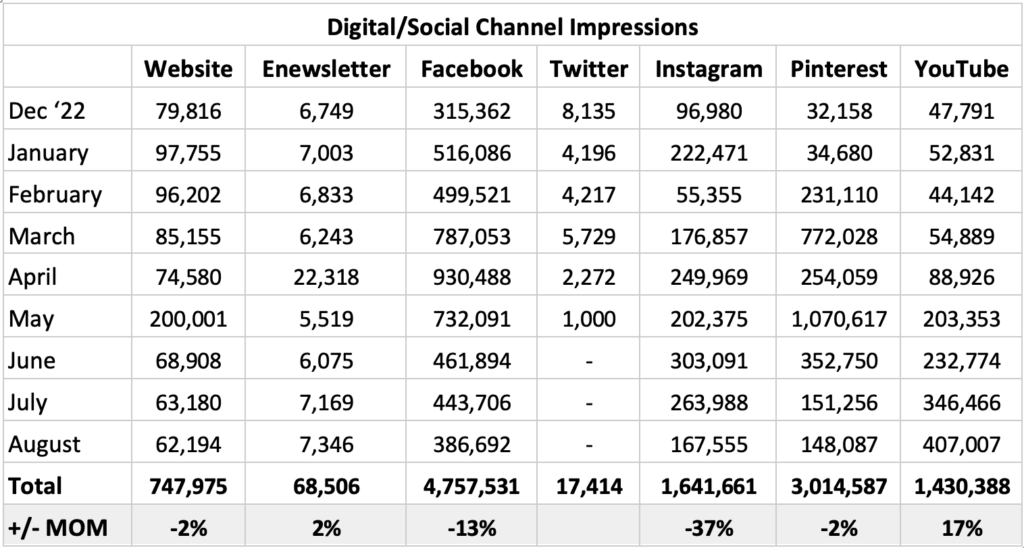

| *YouTube engagement metrics have changed. Digital metrics are constantly evolving, so we created our own updated Engagement metrics (comments + shares + likes + dislikes + subscribers lost + subscribers gained) |

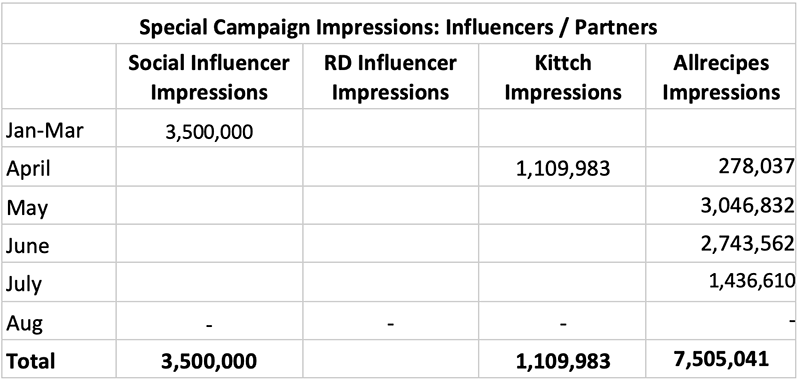

Special Campaign Impressions

Includes paid promotions, partnerships and advertising activities.

To view previous months highlights, please visit the Shipping Report Archive on the MushroomCouncil.org website

Topline Report

Tracker Highlights – Period ending 09/10/2023

- Download Retail Tracker for Period ending 09/10/2023

- Download Fresh Mushroom Sales Review for Period ending 09/10/2023

- Download Mushroom Retail Performance for Period ending 09/10/2023

The Marketplace

August’s summer weather, time off and travel boosted restaurant dining, according to Circana’s consumer survey that found a three-year low in the share of meals prepared at home. Restaurant engagement is typically a bit higher in the summer, but many consumers opted for on-premise dining (53%) and sourcing restaurant meals through takeout (50%) in August. Takeout appears to be a pandemic trend with staying power. This is impacting the types of restaurants and meals people choose, and in turn, drives the importance of mushroom engagement with restaurants and meal types that favor takeout, including convenience stores.

At the same time that restaurant trips had a strong month, summer fruits and vegetables prompted year-on-year pound growth for the fresh produce department, the second month in a row with volume gains. Deli-prepared foods also had a strong August, especially deli pizza, including pizza sold by the slice as well as fully-cooked and ready-to-cook pizzas — underscoring the opportunity to optimize mushroom’s presence in deli-prepared.

With retail inflation easing, consumers’ price perceptions were a bit more optimistic, yet 94% of consumers remain worried over their ability to afford groceries. Preventing at-home food waste has been the biggest change in meal preparation tactics in reaction to the sustained financial pressure, followed by doing more with leftovers and using more simple ingredients. The marketplace is also resulting in somewhat subdued consumer curiosity with only 16% browsing the aisles for new items to buy. Purchases remain in-store centric, omni-channel shopping combining the more frequent in-store trips with online stock-up trips is quite common.

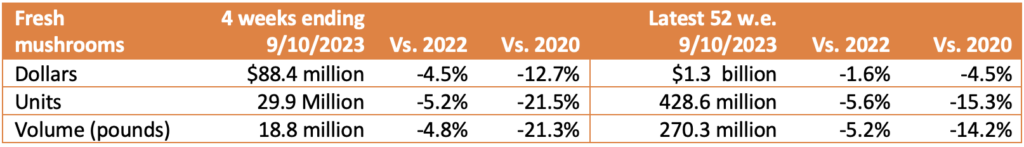

Dollars, Units and Volume Performance

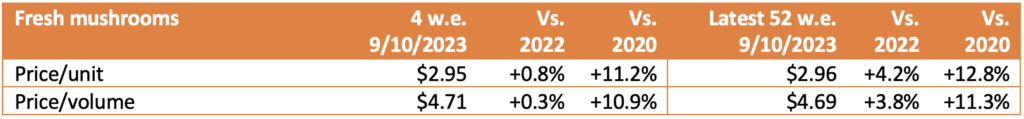

Retailers invested in price on the fruit side with the average cost per pound down 2.1% year-on-year in August. Fresh vegetables did continue to have slight inflation (+1.4%), while fresh mushroom prices were up by 0.8%. Fresh mushroom sales patterns followed those of the total store rather than the produce department in the quad-week period, with unit and volume declines during the shorter and longer time periods. In the latest four weeks, volume declines stayed around 5 points of year ago levels. Importantly, volume declines are moderating somewhat in comparison with the 52-week look that shows pounds down 5.2%.

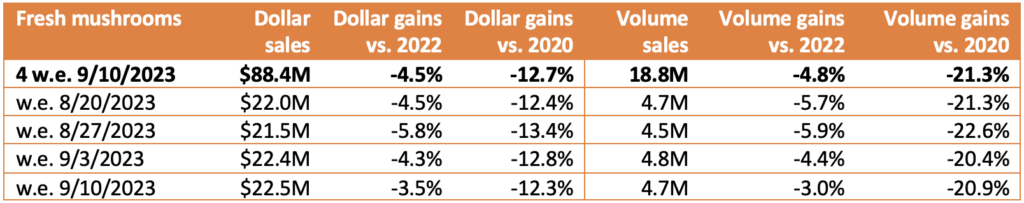

Weekly sales for mushrooms averaged between $21.5 million and $22.5 million in each of the four weeks. The period-over-period sales trends continue to follow long-established patterns (as seen on the forecasting tab). This quad-week period reflects the start of growing volume between now and the early months of the following year.

Inflation

Inflation across total food and beverages is slowing down and mushrooms are following suit. Mushroom prices per unit increased by 0.8% versus year ago in the latest quad-week period. This is down from 4.2% in the 52-week view.

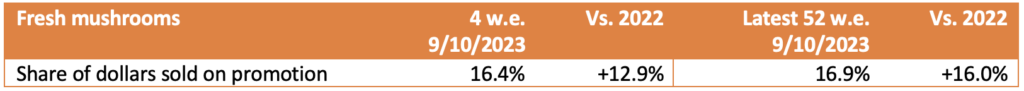

Moderation in price increases went hand-in-hand with an increase in promotional activity in the 52-week view. During the latest quad-week period 16.4% of total fresh mushroom dollars sold while on promotion, which was up 12.9%.

Performance by segment

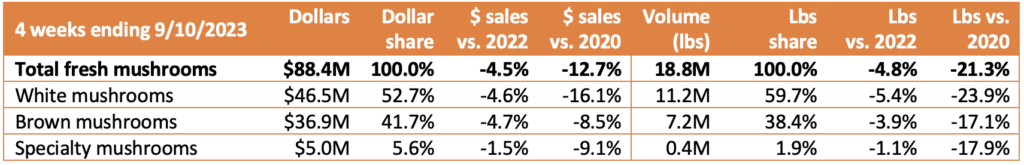

White mushrooms represented 52.7% of mushroom dollars and 59.7% of pounds in the four-week period. Brown mushrooms, the combination of criminis and portabellas, had similar results as white mushrooms, while specialty mushrooms have an above-average performance, driven by shiitake.

Additional observations:

- Package size: 8-ounce packages generated 53.0% of total sales in the four-week period, but dollar sales declined 5.1% versus the same four weeks in 2022. 16-ounce packages represented 18.6% of sales and declined 6.8% in dollars.

- Organic vs. conventional: For total produce, organic sales are underperforming in comparison to conventional. Mushrooms are the opposite. Organic mushrooms made up 10.1% of pounds and have been an above-average performer for months. Over the past 52 weeks, dollar sales increased 2.4% for organic mushrooms versus a 2.1% decline for conventional.

IRI, Integrated Fresh, MULO, YTD and 4 or weeks ending 09/10/2023

We collect, use and process your data according to our Privacy Policy.