Shipping Reports

Shipping Reports

Monthly Shipping and Marketing Report | March 2023

Council Update

Open Positions on the Council (2024-2026 term):

A call for nominations was sent out on February 1, 2023. There are four positions that will be open including:

- Region 1 (All states except CA & PA) – two open positions

- One 2-year term

- One 3-year term

- Region 2 (PA) – one open position (3-year term)

- Region 4 (Imports) – one open position (3-year term)

2023 Council Members:

Elected Officials:

- Chair: Curtis Jurgensmeyer

- Vice Chair: Mike Stephan

- Treasurer: Jack Guan

- Secretary: Meghan Klotzbach

Region 1: All states except CA & PA

- Curtis Jurgensmeyer – J-M Farms – OK – 2nd Term

- Michael Stephan – Monterey Mushrooms – MN – 1st Term

Region 2: PA

- Michael Basciani, Sr. – M.D. Basciani Mushrooms – PA – 1st Term

- Joe Caldwell – Giorgi Mushroom Company – PA – 2nd Term

- Meghan Klotzbach – C.P. Yeatman & Sons – PA – 2nd Term

- Keith Silfee – Needham Mushrooms – PA – 1st Term

Region 3: CA

- Jack Guan – California Terra Garden – CA – 1st Term

Region 4: Imports

- Kim Marks – Highline Mushrooms – ON – 1st Term

Exemption Applications: The exemption applications for the 2023 calendar year were mailed to those who are currently exempt. If you did not receive an application and would like to apply for an exemption, please email [email protected] or download an application here. All exemption numbers beginning with 2022 are no longer valid.

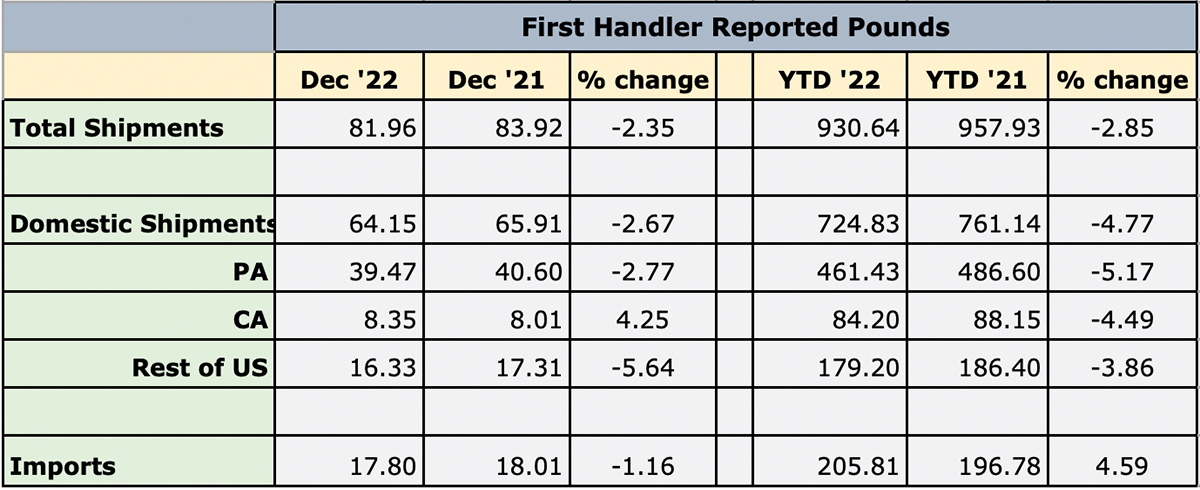

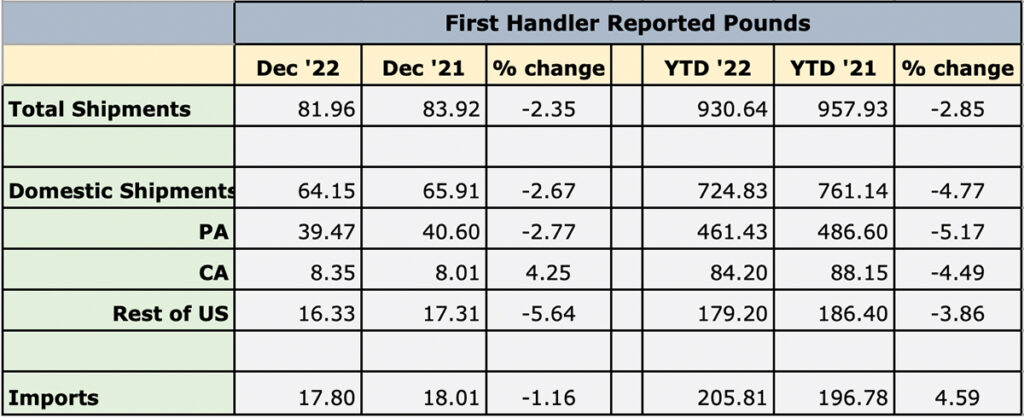

Shipment Summary

To see current charts, click here.

Looking ahead to March

CHILD NUTRITION

- In March, Mushrooms in Schools will be celebrating National Nutrition Month! We will provide Feed Your Immune System resources to celebrate National Nutrition Month via our blog, social media, and newsletter. A bingo card and passport will be used for students to learn more about healthy foods and how to add them in their meals. Additionally, we will be reaching out to our CACFP partners as we prepare for the National CACFP Conference in April. We encourage other channels to amplify Mushrooms in Schools by sharing our posts on Facebook and Twitter.

NUTRITION RESEARCH

- See the article in Mushroom News: Nutrition Research, Filling in the Blanks, here you can read how your investment in nutrition research is progressing and what to look for in the future.

- Confirm submission of research abstracts to Nutrition 2023, annual meeting of the American Society for Nutrition

- Review responses to call for letters of interest to identify behaviors that motivate consumers to initially try and then continue to purchase mushrooms

FOODSERVICE

- As interest in protein analogs (meat mimics) continues to fade, The Blend and Mushrooms are the sought-after ingredients for a center of the plate star. A number of LTOs are in the development or testing phase.

Highlights from February

CHILD NUTRITION

- During February, Mushrooms in Schools highlighted pizza recipes and culinary tips. Additionally, we released our National Nutrition Month resources via our social media and newsletter. Chelsea Public Schools, School Nutrition Association of Pennsylvania, and Knox County Public Schools were highlighted on social media channels.

NUTRITION RESEARCH

- Issued call for letters of intent to identify behaviors that motivate consumers to initially try and then continue to purchase mushrooms. View the letter of Intent.

- Submitted comments regarding revision to FDA definition of “healthy”; View the revision suggestions.

- Monitored the first meeting of the 2025-2030 Dietary Guidelines Committee and participated in the Dietary Guidelines for Americans, 2025-2030 Development Process to stay aware of changes that may influence the mushroom industry. The Council will monitor the deliberations and submit comments to establish mushrooms’ role in the Dietary Guidelines’ healthy eating patterns

- Continued to follow up with current researchers regarding the status of studies. Some results from Dr. Campbell’s clinical trial on health outcomes when eating mushrooms are anticipated during the summer. If you’re interested in the study details please watch the “Nutrition Research” webinar.

- Campbell’s “Assessment of Mushroom Consumption on Cardiometabolic Disease Risk Factors and Morbidities in Humans: A Systematic Review” is now published in Nutrients. While there is limited information from well-controlled clinical trials, the review suggests greater mushroom consumption lowers blood triglycerides and a marker for inflammation – both indices of cardiometabolic health.

- Dr. Williams is preparing a literature review on mushrooms and cognition for submission also during the summer.

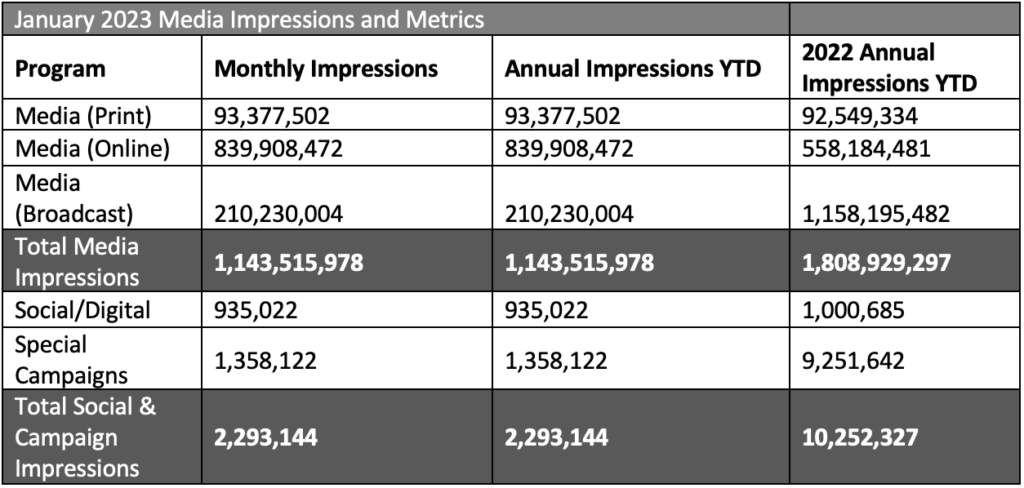

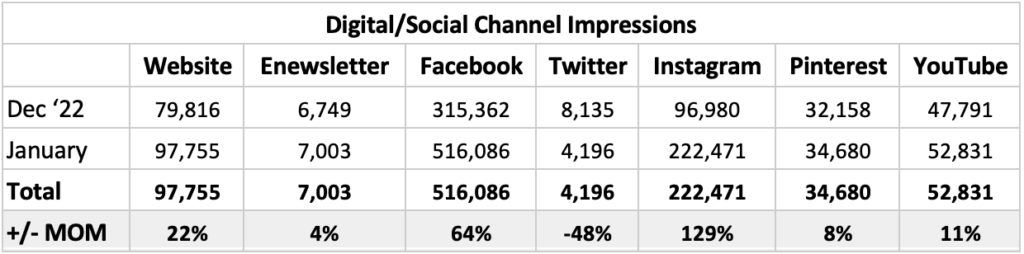

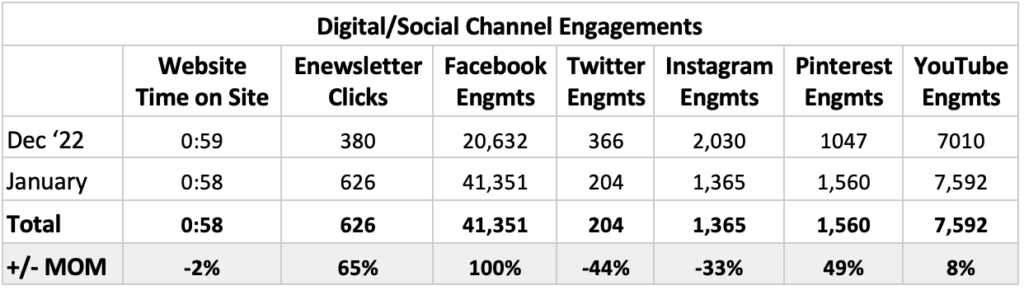

CAMPAIGN Metrics

Notable Impressions Highlights:

- January

- The relaunch of this year’s FYIS campaign resulted in an influx of impressions and engagments across social channels, in particular Facebook (+64% increase in Impressions and 100% increase in Engagements).

- The FYIS kick-off eblast also prompted hundreds more clicks than the month prior, driving users to the FYIS landing page.

- While social impressions and engagements are tracking YOY, digital ad impressions are down compared to January 2022. This could be due to a lower ad budget this year, ad fatigue (3rd year running) and/or audience targeting changes. We are testing and evaluating ad updates to optimize and maximize our impact through the rest of the campaign.

| *Youtube Engagament metrics have changed. Digital metrics are constantly evolving, so we created our own updated Engagement metrics (comments + shares + likes + dislikes + subscribers lost + subscribers gained) |

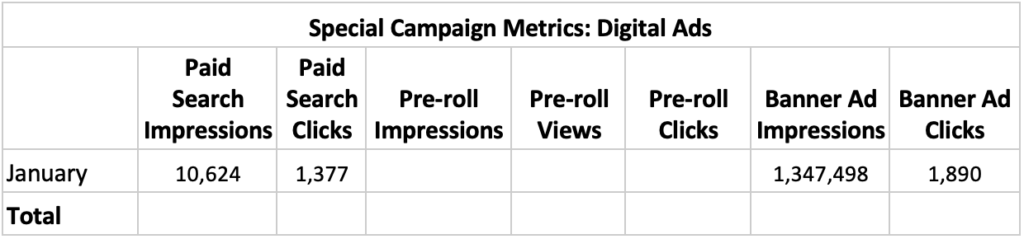

Special Campaign Impressions

Includes paid promotions, partnerships and advertising activities.

Topline Report

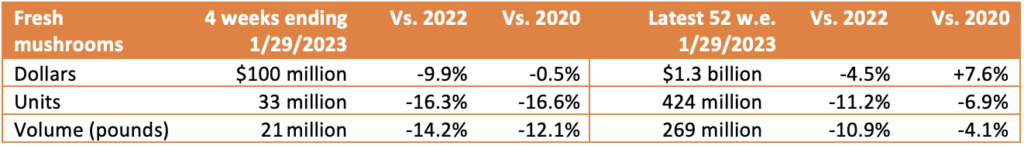

Tracker Highlights – Period ending 01/29/2023

- Download Retail Tracker for Period ending 01/29/2023

- Download Fresh Mushroom Sales Review for Period ending 01/29/2023

- Download Mushroom Retail Performance for Period ending 01/29/2023

January brought a host of New Year’s resolutions. According to IRI, 40% of shoppers plan to eat healthier, 24% aim to get more sleep and 23% want to spend more time with friends/family. However, saving more money was the second most common resolution, at 35% — demonstrating that inflation continues to make its mark.

- 89% of consumers perceive the cost of groceries to be higher, of whom 96% are concerned about it.

- The top five consumer examples of having higher prices are eggs, milk, beef/pork, fresh produce, chicken/turkey and bread — despite meat and produce having below-average inflation.

- This is prompting continued money-saving measures when buying groceries among 79% of Americans, such as buying what’s on sale (49%), cutting back on non-essentials (41%), looking for coupons (33%) and switching to store brand items (31%).

- Special occasions remain a big opportunity for food retail in 2023, with 50% of Americans planning to celebrate Valentine’s Day, of whom 19% plan to cook a special meal at home and 15% planning to go out to a restaurant. Sixteen percent of consumers are staying home specifically to save money.

- Thinking ahead to the April holidays of Easter or Passover, 28% plan to prepare a special meal for the household and 30% will host or attend a meal with extended family or friends.

- Following the typical December uptick in the estimated share of meals prepared at home

Dollars, Units and Volume Performance

The persistent high level of inflation is continuing the now familiar sales patterns for most departments around the store, including fresh produce: dollars up 1.3% year-on-year, but units (-1.0%) and volume (-4.3%) down. The dollar gains for fresh produce were below that of total food and beverages, fully related to differences in inflation that continues to be below average for produce. Additionally, fresh fruit and vegetables lost share to frozen and canned as consumers emphasized price and shelf-life.

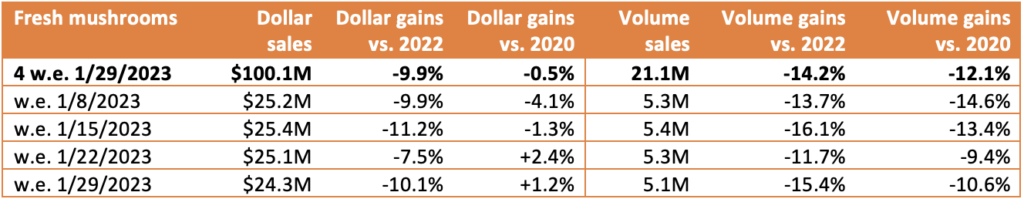

For the four weeks ending January 29th, 2023, fresh mushroom dollars decreased 9.9% year-over-year and volume declined by 14.2%. In the latest 52 weeks, dollars were down 4.5% and pounds 10.9%. Dollars remained ahead of 2020 in the longer-term view, but were down 0.5% in the short-term view. Pounds are now 4.1% behind those of 2020 in the latest 52 weeks and 12.1% in the quad-week view versus pre-pandemic.

- Weekly sales for mushrooms were very consistent, averaging between $24.3 million and $25.4 million, each week. Total pounds averaged between 5.1 and 5.3 million for each of the week. Bucking prior year patterns that show an increase in mushroom sales during this quad week period, volume was down slightly from the prior quad week period (see forecast tab).

Inflation

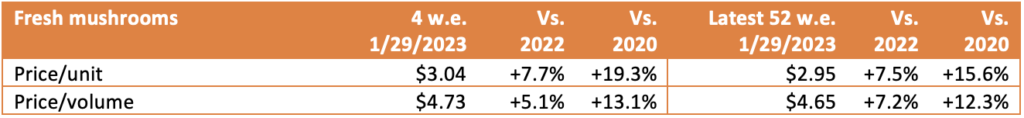

- Mushroom prices per unit increased by 7.7% versus year ago in the latest quad-week period. This means the rate of inflation jumped ahead of that for total fresh vegetables (+8.8%) and total fresh produce (+4.7%).

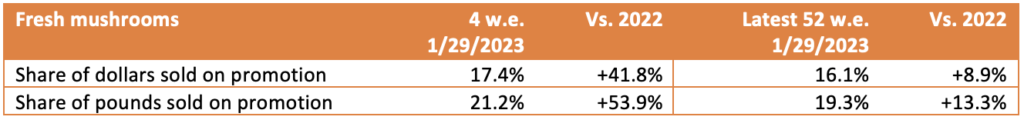

- Promotional activity improved during the latest quad-week period, at 17.4% of total fresh mushroom dollars and 21.2% of total pounds sold. Promotional levels for total fresh produce as well as total food and beverages are also up as consumers are pulling back on units and volume across categories.

Performance by segment

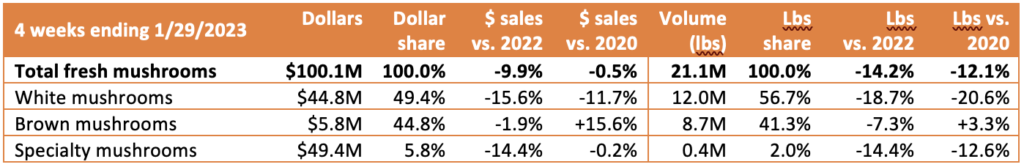

- White mushrooms represented 49.4% of total fresh mushroom dollar sales and 56.7% of pounds in the four-week period. However, it was brown mushrooms, the combination of criminis and portabellas, that fared better with 3.3% pound growth over the 2020 levels, whereas white mushrooms were down 20.6%.

Additional observations:

- Package size: Eight-ounce packages are, by far, the biggest seller and is outperforming 16 ounces in growth.

- Organic vs. conventional: Organic mushrooms made up 10.8% of pounds but far outperformed conventional mushrooms in performance in dollars, units and volume.

- Cut/prepared versus whole mushrooms: Cut or prepared mushrooms made up 48.0% of pound sales in the four-week period. Mushrooms without preparation had the better performance.

IRI, Integrated Fresh, MULO, YTD and 4 weeks ending 01/29/2023

We collect, use and process your data according to our Privacy Policy.