Shipping Reports

Shipping Reports

Monthly Shipping and Marketing Report | June 2023

Council Update

Open Positions on the Council (2024-2026 term):

Ballots have been sent out. Please complete your ballot and return via email ([email protected]) or by postal mail to 200 NE Missouri Rd, Ste 200, Lees Summit, MO 64086.

- Region 1 (All states except CA & PA) – two open positions

- One 2-year term

- One 3-year term

- Region 2 (PA) – one open position (3-year term)

- Region 4 (Imports) – one open position (3-year term)

Council Meeting:

The next Council meeting will be held on June 22 in San Jose, CA. If you are interested in attending, please let us know so we can be sure you are accommodated.

Council Webinars:

See past webinars here: Mushroom Council Industry Member Webinars

Recently Approved Materials

- Industry e-Blasts:

- Organic Mushroom White Paper

- Nutrition Newsletter – Q2 2023

- Mushroom Cocktail Recipes

- Recipe of the Month (May) – Mix it up with Mushrooms

- Recipe of the Month (June) – The Summer of Mushrooms

- Mushrooms in the News:

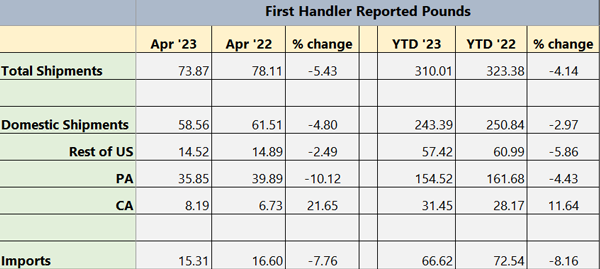

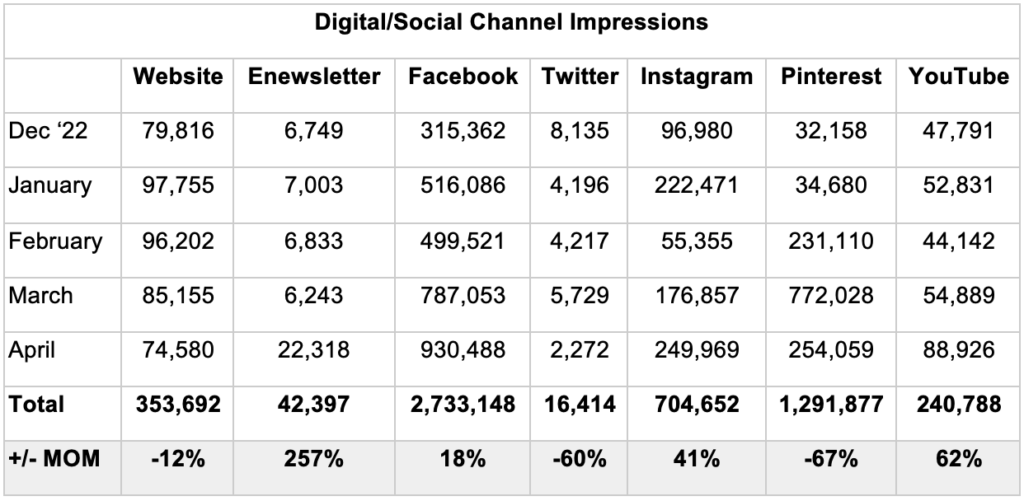

Shipment Summary

To see current charts, click here.

Marketing Assets for June

Allrecipes Campaign

Add some interest to your website or social media header with new moving banners in the Allrecipes campaign folder.

Channel Highlights

CONSUMER

- This past Memorial Day weekend, the Mushroom Council® celebrated the kick-off to grilling season in Austin, Texas, at the premier barbecue festival, Hot Luck with Wicked Kitchen’s co-founders, chefs and brothers Derek and Chad Sarno. The team served grilled lion’s mane mushroom “steak,” black pearl oyster mushroom “poke,” portabella shawarma tacos and BBQ oyster mushroom “burnt ends” to 2,500 hungry barbecue enthusiasts.

- We are partnering with Allrecipes for a “Mix it Up With Mushrooms” contest from May through October. Allrecipes Allstars created 5 blended recipes for the home cook. Vote for your favorite Allstar recipe to be entered to win $1,000. Share this contest with your workers, clients and community.

NUTRITION PROMOTION

- In May, our PR team attended the 2023 Today’s Dietitian Spring Symposium in Savannah, Georgia and connected with 400 dietitians.

FOODSERVICE

- Coordinated a feature article “Mushrooms Trend as a Meat Alternative on Restaurant Menus with Nation’s Restaurant News.

INDUSTRY COMMUNICATIONS

- The Mushroom Council commissioned shopper research to determine which messages, statements and slogans are the most impactful on pack, and to understand why. Watch the 15-minute summary of our newest label research.

NUTRITION RESEARCH

June:

- Prepare 2023 nutrition research update, draft 2024 program activities and budget for June 22 meeting of the Council.

May:

- Attended May 10 virtual meeting of the Dietary Guidelines Advisory Committee

- Reviewed FDA Dietary Guidance Statements for food labeling

MUSHROOMS IN SCHOOLS

- Availability of Portabellas: As we have started to pilot testing in school districts large and small, one thing stands out: most of the produce houses I have dealt with “locked” portabella slots for their “regular” portabella buyers. That is impeding new sales of portabellas, to my schools and other commercial operations. As you talk to your distributors, if you want to sell more value-added portabellas let them know that. Schools (and most commercial operations) dislike and avoid special orders, especially for produce since they are expensive and unpredictable.

June:

- In June, Mushrooms in Schools will be publicly releasing our Portable Portabella Burger promotion! We will be highlighting the newly created resources and recipes from the Portable Portabella Burger toolkit for our audience via our newsletter, social media, and blog. This release is in anticipation of an upcoming event, School Nutrition Association’s Annual National Conference, where we will have these materials available for child nutrition programs at our booth. Our giveaways for schools and CACFP will occur to increase engagement from these stakeholders as well as gathering wonderful mushrooms recipes. We encourage other channels to amplify Mushrooms in Schools by sharing posts on Facebook and Twitter.

May:

- During May, Mushrooms in Schools celebrated summer meals. We highlighted resources, recipes, and giveaways to celebrate summer meals. Memphis-Shelby County Schools, Browns Child Care, Everett Public Schools Food & Nutrition Services were highlighted on social media channels.

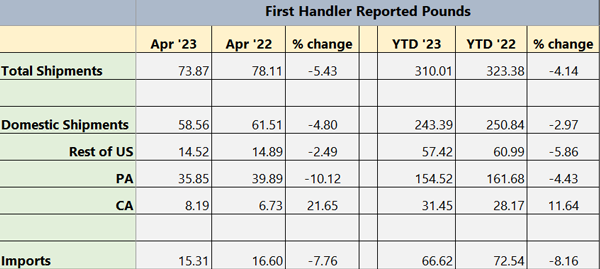

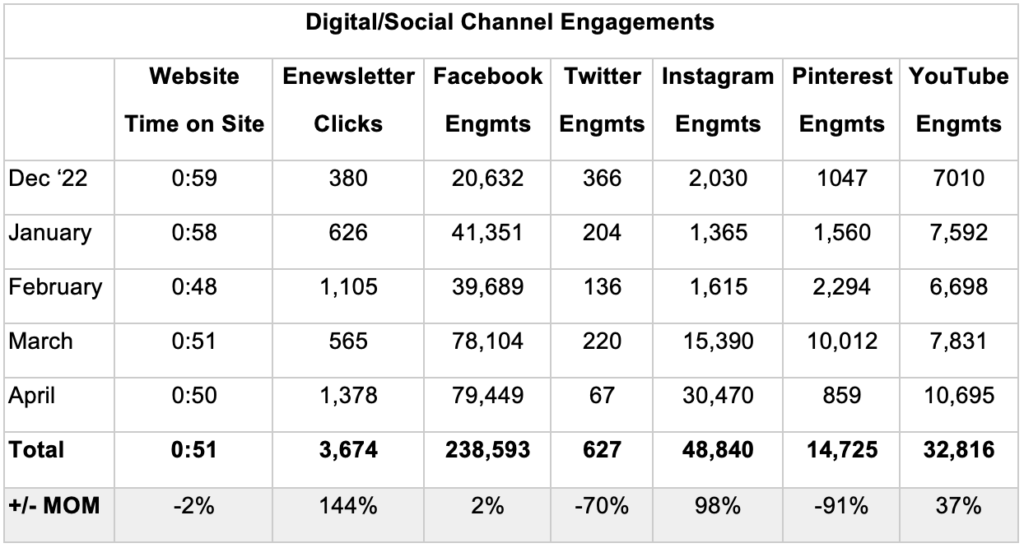

Marketing Summary

Notable Highlights for April

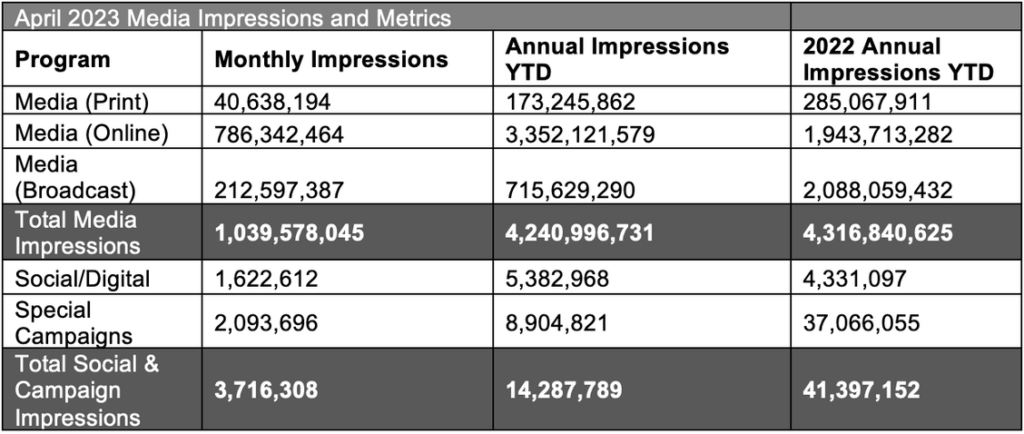

- Although we had a decrease in ad spend on Instagram from last year, we saw an increase of engagements on our posts. One large driver of engagements inApril was the post asking users to pick their favorite recipe. This led to 77 comments, 28 shares, 126 saves and 388 likes which were primarily organic.

- On Pinterest our traffic to our website is up significantly from last year. We are going to continue to push this platform and look for ways to optimize our creative and copy to perform even better.

- With the increase to weekly e-blast this month, we saw a dramatic increase in e-newsletter opens and clicks.

- To note, we are shifting efforts away from Twitter with plans to monitor for questions only in the future. Expect to see drops in results on that channel as a result.

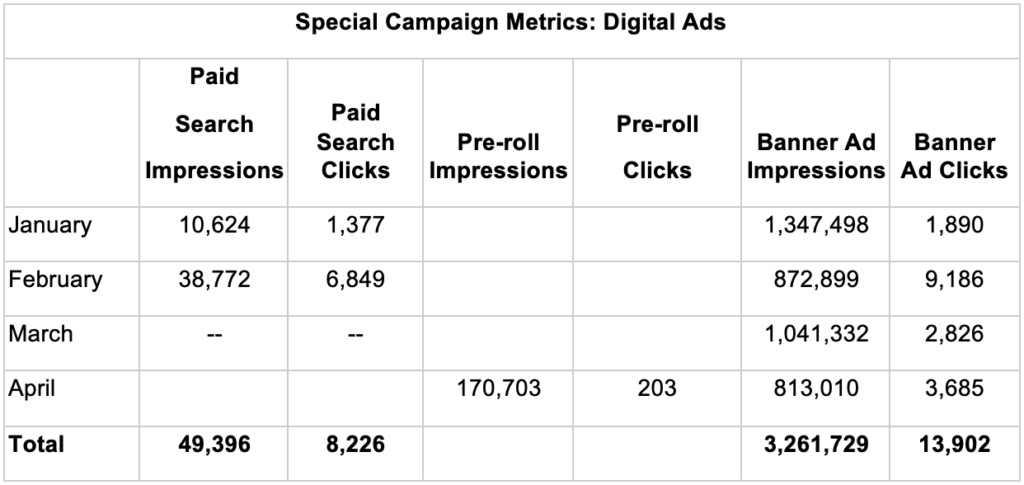

- We ran three different digital ad strategies this month targeting HomeChefs for Earth Month:

- Prospecting: Display (banner ads pointing to MC Earth Month landing page)

- Prospecting: Kittch (banner ads pointing to Kittch streams)

- Prospecting: Pre-Roll (pre-roll ad pointing to Kittch streams)

- Despite lower impressions from last year, the CTR on our digital ads is outstanding, besting the industry benchmark of 0.07%. The CTR for MC digital ads for this month was .4%, an increase of 35% compared to the previous month.

- Pre-Roll performed great from a brand awareness standpoint, as 87,875 users watched the video in full.

| *Youtube engagement metrics have changed. Digital metrics are constantly evolving, so we created our own updated Engagement metrics (comments + shares + likes + dislikes + subscribers lost + subscribers gained) |

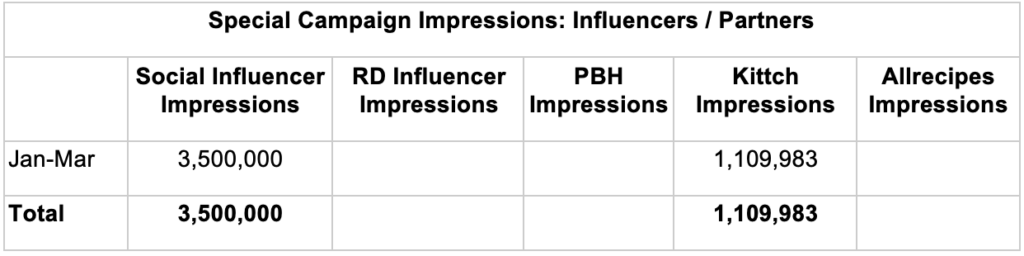

Special Campaign Impressions

Includes paid promotions, partnerships and advertising activities.

Topline Report

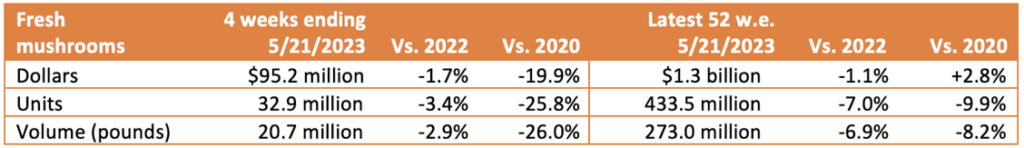

Tracker Highlights – Period ending 05/21/2023

- Download Retail Tracker for Period ending 05/21/2023

- Download Fresh Mushroom Sales Review for Period ending 05/21/2023

- Download Mushroom Retail Performance for Period ending 05/21/2023

The Markeplace

- As high levels of inflation persist, so are consumers’ money-saving measures. This has resulted in the combination of more store trips as shoppers chase deals. Additionally, the average number of items per shopping trip continues to fall as shoppers adjust purchases to balance their budgets. Fresh vegetables have also experienced volume pressure for a long time. Fruit, that has experienced three months of deflationary conditions, did grow pound sales, which pulled April total fresh produce volume sales into the black for the first time in 21 months, at +0.6% versus year ago levels. Per the April Circana survey of primary grocery shoppers:

- The consumer-estimated share of meals prepared at home rose to 80%, with above average shares for lower-income and fixed-income shoppers.

- 22% of consumers plan to source fewer restaurant meals. Restaurant takeout (ordered by 50% of consumers in the past month) continues to see higher engagement than on-premise dining (48%).

- When buying groceries, a survey high of 85% of consumers apply one or more money-saving measures, led by looking for sales promotions (53%), cutting back on non-essentials (46%) and buying store brands more often (34%).

- At the same time, consumers are changing behaviors inside the home: 40% of consumers noted they are more conscious of using up fresh foods before they go bad, 39% are using leftovers more and 25% are using more simple ingredients.

Dollars, Units and Volume Performance

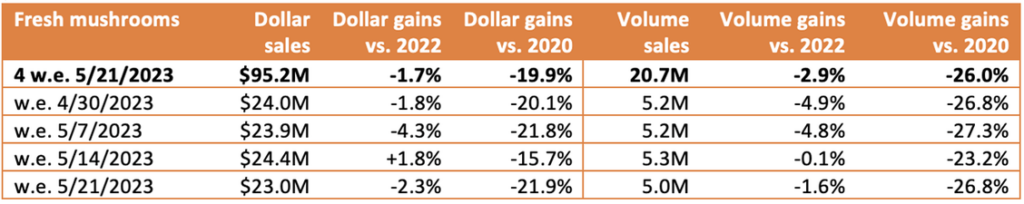

Total food and beverage dollar sales increased 4.7% over the quad-week period, but units were down 2.3%. For the four weeks ending May 21st 2023, fresh produce dollar sales were flat (-0.2%) and fresh mushroom sales were down 1.7% year-on-year. This data has been adjusted for the supercenter data error.

Fresh mushrooms experienced unit and volume declines during the shorter and longer time periods. In the latest four weeks, volume declines stayed within 3 points of year ago levels. Importantly, volume declines are moderating in comparison with the 52-week look that shows pounds down 6.9%.

Weekly sales for mushrooms were extremely consistent, averaging between $23.0 million and $24.4 million in each of the four weeks. The period-over-period sales trends continue to follow long-established patterns (as seen on the forecasting tab). While volume remains below 2019 levels, the gap grew smaller in the latest four weeks.

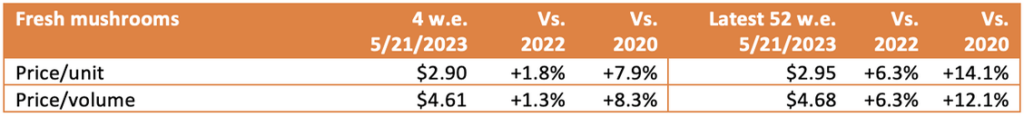

Inflation

Inflation in vegetables is moderating and mushrooms are following suit. Mushroom prices per unit increased by 1.8% versus year ago in the latest quad-week period. This is down from 6.3% in the 52-week view.

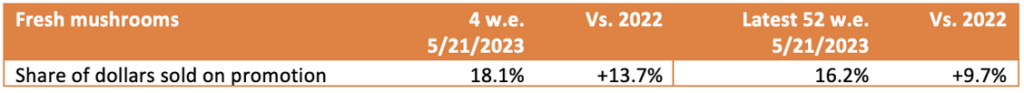

Moderation in price increases goes hand-in-hand with an increase in promotional activity. During the latest quad-week period 18.1% of total fresh mushroom dollars sold while on promotion. Promotional levels for total fresh produce as well as total food and beverages also increased substantially year-on-year, but were still below the 2020 pre-pandemic levels.

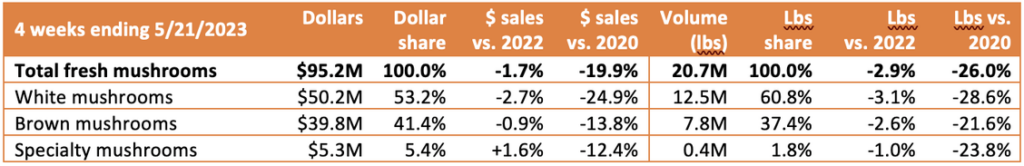

Performance by segment

White mushrooms represented 53.2% of mushroom dollars and 60.8% of pounds in the four-week period. Note: the two missing UPCs were an 8-ounce white and 8-ounce sliced white, which means these numbers have changed considerably since the data correction. Brown mushrooms, the combination of crimin is and portabellas, fared better than white mushrooms, with crimini coming in just 0.2% below year ago levels in the latest four weeks.

Additional observations:

- Package size: 8-ounce packages generated 51.8% of total sales in the four-week period, but dollar sales declined 2.9% versus the same four weeks in 2022. 16-ounce packages represented 19% of sales and grew 1.3% in dollars, while also showing a better-than-average unit and volume performance.

- Organic vs. conventional: Organic mushrooms made up 10.4% of pounds and have been an above-average performer. Dollar sales increased 4.6% along with unit growth of 3.5%.

IRI, Integrated Fresh, MULO, YTD and 4 weeks ending 05/21/2023

We collect, use and process your data according to our Privacy Policy.