Shipping Reports

Shipping Reports

Monthly Shipping and Marketing Report | April 2023

Council Update

A call for nominations was sent out on February 1, 2023. There are four positions that will be open including:

- Region 1 (All states except CA & PA) – two open positions

- One 2-year term

- One 3-year term

- Region 2 (PA) – one open position (3-year term)

- Region 4 (Imports) – one open position (3-year term)

Council Meeting: The next Council meeting will be held on June 22-23 in San Jose, CA.

Council Webinars

Did you miss our latest webinar on the upcoming Allrecipes.com partnership? The presentation deck can be found below.

See past webinars here: Mushroom Council Industry Member Webinars

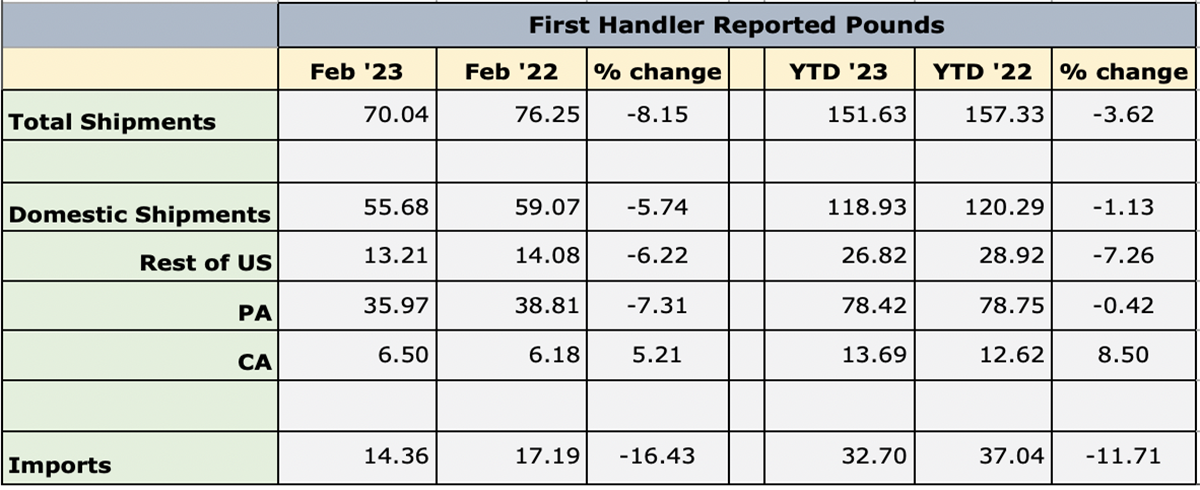

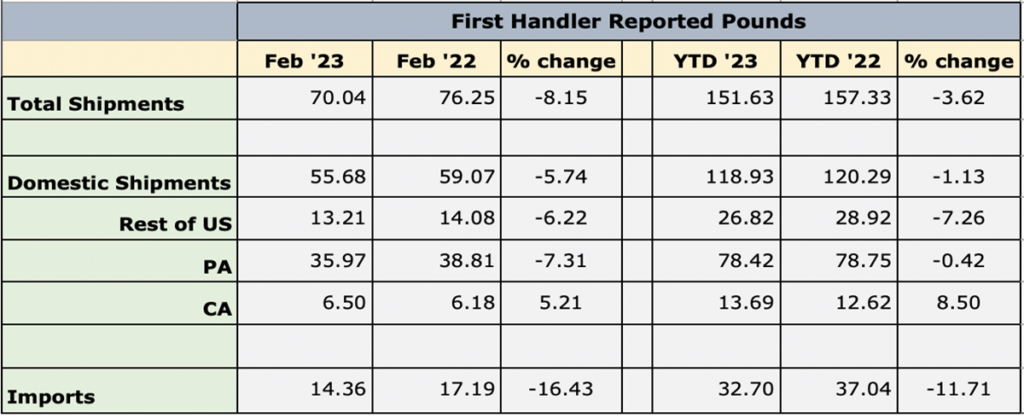

Shipment Summary

To see current charts, click here.

Highlights from March

CHILD NUTRITION

- During March, Mushrooms in Schools celebrated National Nutrition Month with two new resources – Elementary Bingo Card and Secondary Passport based on Feeding Your Immune System. Chelsea Public Schools and Gwinnett County School Nutrition Program were highlighted on social media channels.

RETAIL RESEARCH

- Following our Executive Industry Townhall last week, Anne-Marie Roerink, our retail channel manager, developed a mushroom engagement report to provide insight into changes in fresh mushroom household penetration, grocery store trips and retail spend.

NUTRITION RESEARCH

- Four Letter of Interest to discover attributes that motivate mushroom trial and support sustained usage received by the Feb. 15 deadline and a consumer scientist identified for the Research Advisory Panel to assist in the evaluation.

CONSUMER PROMOTION

- Feed Your Immune System campaign continues with TikTok content, a “Soup It Forward” giveaway for 4 Le Creuset cocoettes and mushroom soup recipes.

FOODSERVICE

- March 6 LTO launch of the Buford Burger and Fried Mushroom side. Collaboration with Checkers, Curious Plot and Industry to amplify and widen the reach of PR

Looking ahead to April

CHILD NUTRITION

- Mushrooms In Schools will be celebrating sustainability! We will be highlighting resources and recipes to our CACFP audience via our newsletter, social media, and blog. Additionally, Mushrooms in Schools will be attending the National CACFP Conference. Our giveaways for schools and CACFP will occur to increase engagement from these stakeholders as well as gathering wonderful mushrooms recipes. We encourage other channels to amplify Mushrooms in Schools by sharing posts on Facebook and Twitter.

- Mushrooms in Schools will be attending the National Child and Adult Care Food Program Annual Conference from April 10-14. For more information on how to attend, please contact Malissa Marsden, [email protected]

CONSUMER PROMOTION

- Partnering with Kittch on campaign activation “Champignons of Earth Month.” Kittch is reaching out to 4 chefs to feature weekly during April.

CONSUMER MEDIA

- Planning Earth Month media dinner, deliveries and farm site tours timed for spring months

FOODSERVICE

- Further planning for Mushroom Culinary Immersion on schedule with all Disney Company Culinary Directors/F&B Leadership and R&D for Disney Proprietary Blended Burger

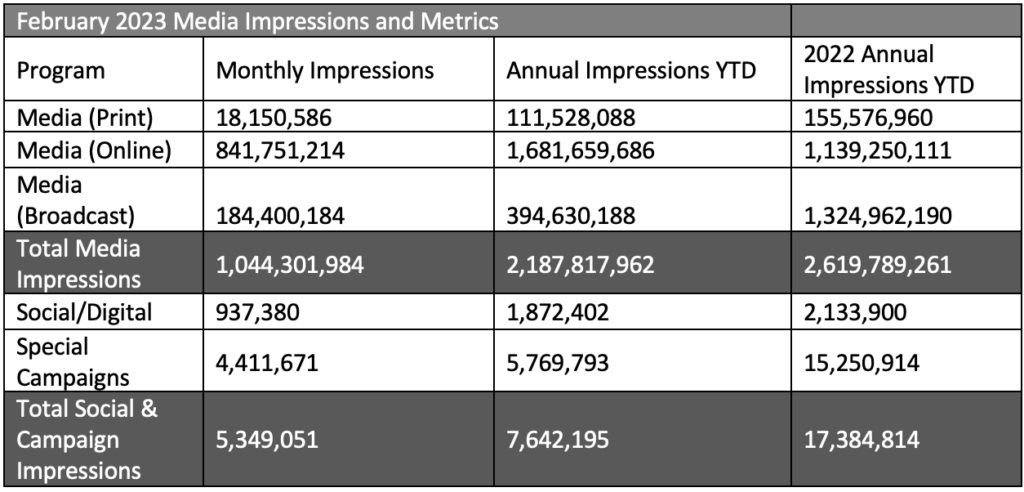

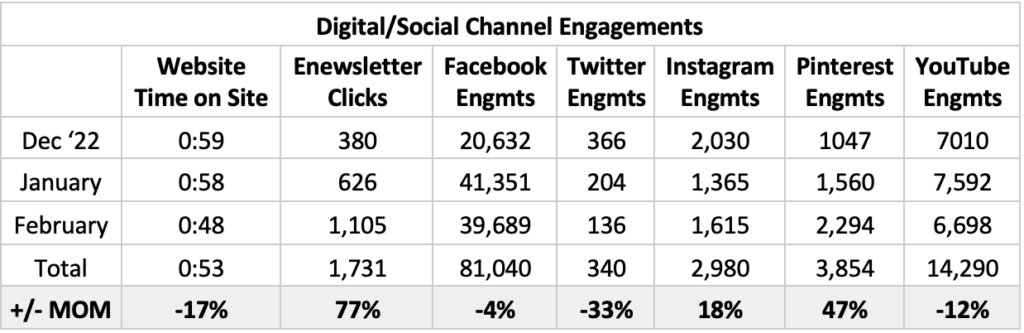

CAMPAIGN Metrics

Notable Impressions Highlights:

- February

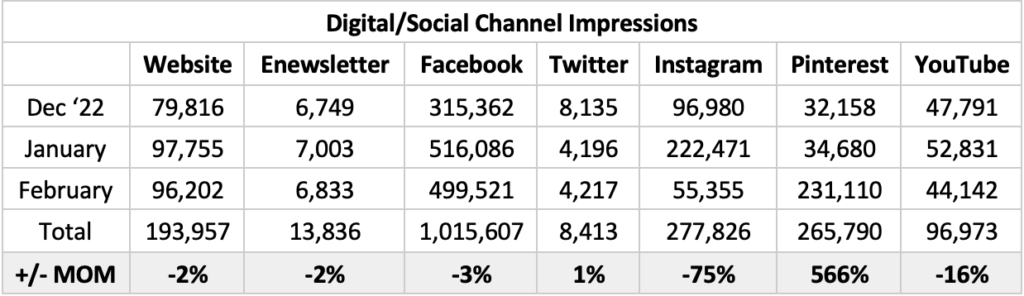

- Overall impressions from the MC social channels dipped compared to last month but remain consistent with results YOY.

- We shifted budget from Instagram and Facebook to Pinterest, which is reflected in the dramatic increase in engagements and impressions.

- Due to the inclusion of the “Feed Your Immune System with Soup” giveaway in the enewsletter, we saw a 77% increase in clicks. 28% of the total clicks were to the Facebook post, followed by the FYIS Exlusive Recipe Card Download.

- Pinterest impressions and engagements also saw an incredible spike due to reallocation of paid spend on this channel.

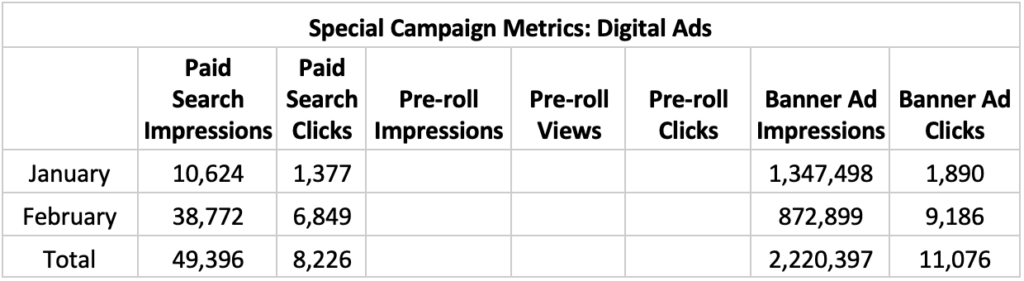

- Digital ad results are up from January, but continue to underperform compared to 2021 due to an increase in cost per impression and competition. We’re continuing to test and evaluate updates to help optimize throughout the rest of the campaign – and future campaigns.

| *Youtube Engagament metrics have changed. Digital metrics are constantly evolving, so we created our own updated Engagement metrics (comments + shares + likes + dislikes + subscribers lost + subscribers gained) |

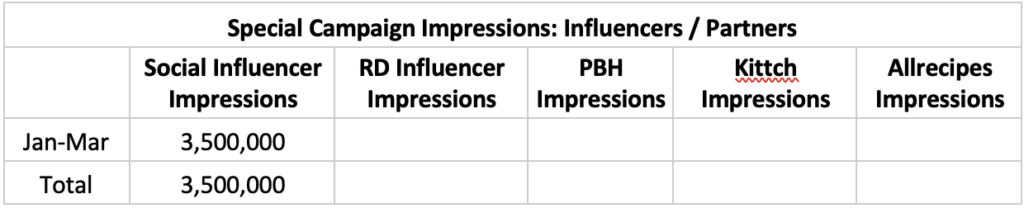

Special Campaign Impressions

Includes paid promotions, partnerships and advertising activities.

Topline Report

Tracker Highlights – Period ending 02/26/2023

- Download Retail Tracker for Period ending 02/26/2023

- Download Fresh Mushroom Sales Review for Period ending 02/26/2023

- Download Mushroom Retail Performance for Period ending 02/26/2023

January brought a host of New Year’s resolutions. According to IRI, 40% of shoppers plan to eat healthier, 24% aim to get more sleep and 23% want to spend more time with friends/family. However, saving more money was the second most common resolution, at 35% — demonstrating that inflation continues to make its mark.

- Inflation stayed in the spotlight in February 2023. Food and beverage prices rose double digits over last year’s double digits in both January (+13.2% vs. YA on a per unit basis) and February. This is prompting continued concern and a host of money-saving measures, especially among lower- and fixed-income households.

- 96% of consumers are concerned over the high cost of groceries, according to IRI. Eggs are the first and foremost example cited by consumers for being more expensive, followed by milk, beef/pork, fresh produce, chicken/turkey and bread. In reality, inflation in fresh meat and produce is far below average.

- Inflation is prompting continued grocery money-saving measures among 79% of Americans, such as buying what’s on sale (49%), cutting back on non-essentials (41%), looking for coupons (33%) and switching to store brand items (31%). At the same time, consumers report seeing fewer items on sale (54%) and the items on sale not being discounted as much (45%).

- 45% stock up on certain items out of concern that prices may rise further or they might not be available.

- In-store shopping remained prevalent, at 85% of trips. Two-thirds of shoppers exclusively buy in-store, whereas 11% buy most or all groceries online.

- Special occasions remain a big opportunity for food retail in 2023. During the pandemic years, several foodservice holidays, such as Valentine’s Day and Mother’s Day, turned home-centric. This moved significant spending into retail, adding to holidays that were already mostly celebrated at home, such as Labor Day and the Fourth of July. Holidays typically boost spending far above a normal week with opportunities for departments around the store.

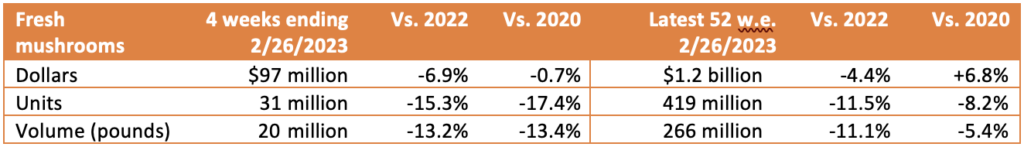

Dollars, Units and Volume Performance

The persistent high level of inflation is continuing the now familiar sales patterns for most departments around the store. Total food and beverage sales increased 9.0% over the quad-week period, above that of fresh produce (+1.6%) and mushrooms (-6.9%). This was fully related to differences in inflation levels as all areas had declines in units and volume. Inflation is especially low on the fresh fruit side of the business.

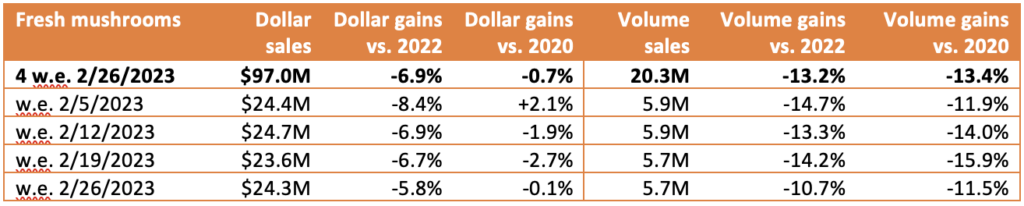

For the four weeks ending February 26th, 2023, fresh mushroom dollars decreased 6.9% year-over-year and volume declined by 13.2%. Year-to-date, dollars were down 4.4% versus year ago and pounds 11.1%. Dollars remained ahead of 2020 in the longer-term view, but were down 0.7% in the short-term view. Pounds are now 5.4% behind those of 2020 in the year-to-date views and 13.4% in the quad-week view versus pre-pandemic.

Weekly sales for mushrooms averaged between $23.6 million and $24.7 million, which was in line with the weekly levels of the past few months. Pound sales averaged between 5.7 and 5.9 million per week. The period-over-period sales trend fell back into the prior-year patterns (as seen on the forecasting tab) but remains well below 2019 levels at this point in terms of absolute pounds.

Inflation

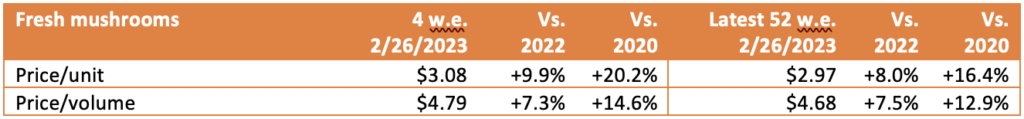

Mushroom prices per unit increased by 9.9% versus year ago in the latest quad-week period. This means the rate of inflation jumped ahead of that for total fresh vegetables (+7.3%) and total fresh produce (+2.4%).

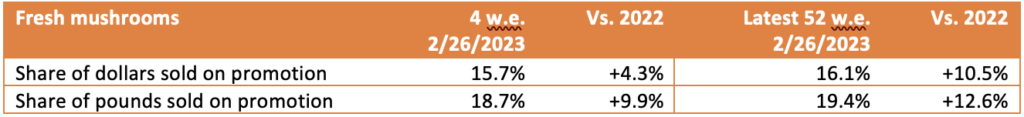

Promotional activity improved during the latest quad-week period, at 15.7% of total fresh mushroom dollars and 18.7% of total pounds sold. Promotional levels for total fresh produce as well as total food and beverages are also up a bit year-on-year, but still below the 2020 pre-pandemic levels.

Performance by segment

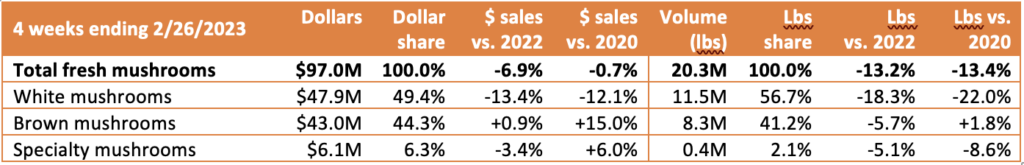

White mushrooms represented 49.4% of total fresh mushroom sales and 56.7% of pounds in the four-week period. However, it was brown mushrooms, the combination of criminis and portabellas, that fared better with 1.8% pound growth over the 2020 levels, whereas white mushrooms were down 22.0%.

Additional observations:

- Package size: Eight-ounce packages are, by far, the biggest seller and is outperforming 16 ounces in growth

- Organic vs. conventional: Organic mushrooms made up 10.4% of pounds but far outperformed conventional mushrooms in performance in dollars, units and volume.

- Cut/prepared versus whole mushrooms: Cut or prepared mushrooms made up 47.5% of pound sales in the four-week period. Mushrooms without preparation had the better performance — perhaps a cost-saving measure on behalf of consumers.

IRI, Integrated Fresh, MULO, YTD and 4 weeks ending 02/26/2023

We collect, use and process your data according to our Privacy Policy.