Shipping Reports

Shipping Reports

Monthly Shipping and Marketing Report | May 2023

Council Update

Nominations are now closed. Ballots will be mailed on June 1, please be on the lookout for your ballot via email and postal mail.

- Region 1 (All states except CA & PA) – two open positions

- One 2-year term

- One 3-year term

- Region 2 (PA) – one open position (3-year term)

- Region 4 (Imports) – one open position (3-year term)

Council Meeting: The next Council meeting will be held on June 22-23 in San Jose, CA. If you are interested in attending, please let us know so we can be sure you are accommodated.

Council Webinars

Did you miss our latest webinar on the upcoming Allrecipes.com partnership? The presentation deck can be found here: https://www.dropbox.com/s/imfa9tfa2udi87t/MC-2023_Allrecipes_Mix-it-up-with-mushrooms_Webinar-APPROVED.pdf?dl=0

See past webinars here: Mushroom Council Industry Member Webinars

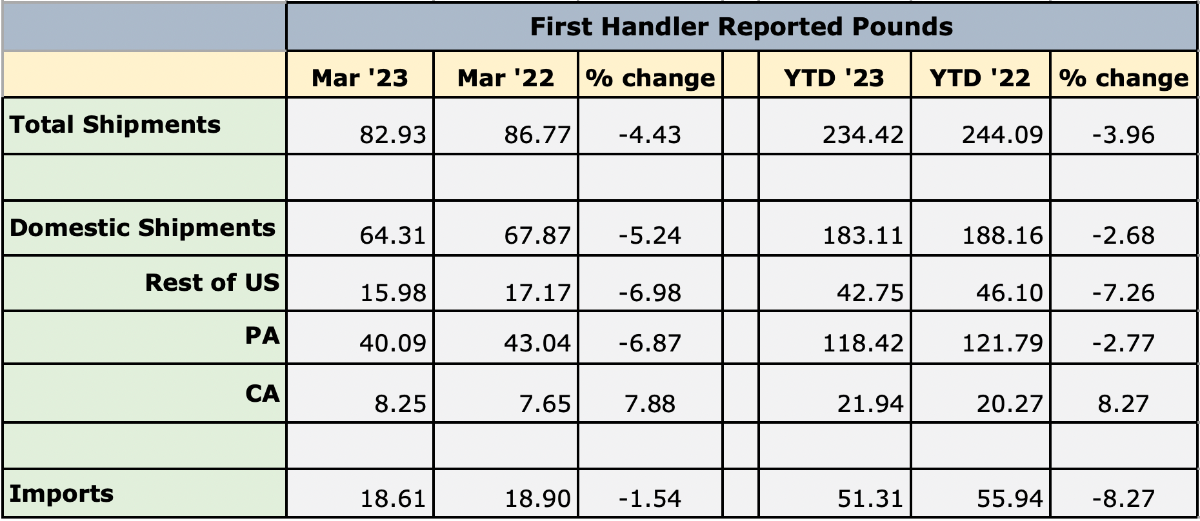

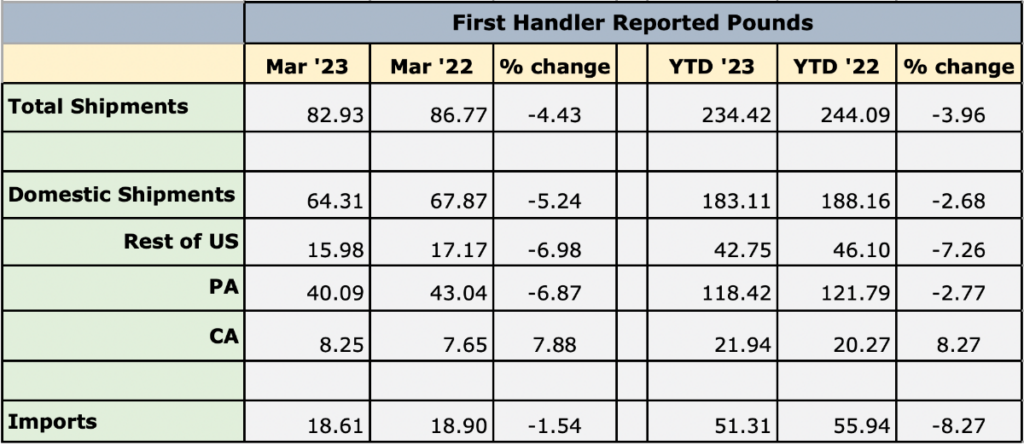

Shipment Summary

To see current charts, click here.

Marketing Assets for May

- Allrecipes Assets:

- Allrecipes Webinar:

Channel Highlights

INDUSTRY COMMUNICATIONS

- Did you miss the webinar about our Allrecipes partnership & marketing materials? Don’t worry, you can catch the recording using the link above.

- Next month, we will be sharing the results of our current label study completed by Lieberman. We will be sharing a video presentation later this month covering the ideal label components and which on-pack messages consumers respond to the strongest.

CONSUMER

- Our Earth Month Campaign in April highlighted mushrooms as an earth-friendly food. Kittch chefs, our “Champignons of Sustainability,” created 4 more cooking videos showing how to make delicious, earth-friendly dishes in 30 minutes. We encourage you to use these links on your social channels.

- We are partnering with Allrecipes for a “Mix it Up With Mushrooms” contest from May through October. Allrecipes Allstars created 5 blended recipes for the home cook. Vote for your favorite Allstar recipe to be entered to win $1,000. Share this contest with your workers, clients and community.

- If you are in or around Austin, TX over Memorial Day Weekend, consider attending the Annual Hot Luck Fest where we will be promoting mushrooms & The Blend.

PR

- Earth Month media dinner was attended by 80+ media and influencers, including New York Times, Real Simple, The Atlantic and Insider. We have already seen multiple articles by attendees in the Nation’s Restaurant News, Producer Market Guide and The Packer.

NUTRITION PROMOTION

- We attended the 2023 PBH Consumer Connection Conference in Scottsdale, AZ. One-on-ones were held with several media dietitians as well as other industry peers. Mushrooms made the list of 2023 Food Trend Predictions.

- We hope to see you at the 2023 Today’s Dietitian Spring Symposium from May 14 – 17 in Savannah, Georgia. Our PR team is attending to spread the word about the powers of the antioxidant ergothioneine. Come chat with us at booth #41.

NUTRITION RESEARCH

- Campbell, W. Nutrimetabolomics and human health promotion of mushrooms with measures of inflammation and brain health through questionnaires completed with data being analyzed. Abstract What’s in a Mushroom? Dietary Mushroom Metabolomics Profiling Using Untargeted Metabolomics and Targeted Amino Acid Analysis accepted for Nutrition 2023, annual meeting of the American Society for Nutrition July 22-25.

- Williams, C and Shukitt-Hale, B. Randomized controlled trial to investigate the cognitive, neurological, and metabolic effects of acute and chronic mushroom intervention in older adults oyster short term study completed. Dose response short term study to add dried fresh lion’s mane fruiting body approved by Council to the previously approved use of supplement powder (mycelium and fruiting body). Potential for abstract to be submitted on the acute oyster dose response study to Food Bioactives and Health Conference (FBHC) which is in Prague this September. Investigators are considering an abstract for the February 2024 meeting of the International Society for Mushroom Science (ISMS) in Las Vegas.

- The Research Advisory Panel and MC staff are reviewing Letters of Interest for a new research study to discover attributes that motivate mushroom trial and support sustained usage.

- Mary Jo Feeney will attend the May 10 virtual meeting of the Dietary Guidelines Advisory Committee. Registration is open to the public.

RETAIL

- Read and use our newest retail reports:

- Mushroom Engagement

- Private Label Trends

- Throughout this month, look for more special retail reports on organic mushrooms and stuffed mushrooms in produce, meat and deli departments.

- Follow us on LinkedIn to see visualizations of best merchandising practices.

FOODSERVICE

- Pam Smith gave a “Changing Face of Foodservice” Executive Brief to explain the current foodservice industry conditions to owners and executives in the mushroom industry. The presentation deck will be shared in the next few weeks.

- The Culinary Institute of America and the Mushroom Council are proud to present “Mushrooms in the Plant-Forward Kitchen,” a video education series developed to inform chefs about the many ways to incorporate mushrooms into global plant-forward cooking. Please share these resources with your foodservice customers.

- Food item development sessions with several companies, including a May 22 meeting with Mod Pizza and Brucepak for a Blended Meatball and Shroom Pizza LTO.

CHILD NUTRITION

- During April, Mushrooms in Schools celebrated sustainability. We highlighted resources, recipes, and giveaways to celebrate sustainability. Mushrooms in Schools was on the road traveling to the Memphis Food Show, National CACFP Conference, and American Commodity Distribution Association. Jackson Child Care, Everett Public Schools Food & Nutrition, and PPS Nutrition Services were highlighted on social media channels.

- In May, Mushrooms in Schools will be celebrating summer meals! We will be highlighting resources and recipes for our audience via our newsletter, social media, and blog. Our giveaways for schools and CACFP will occur to increase engagement from these stakeholders, as well as to gather wonderful mushroom recipes. We encourage other channels to amplify Mushrooms in Schools by sharing posts on Facebook and Twitter.

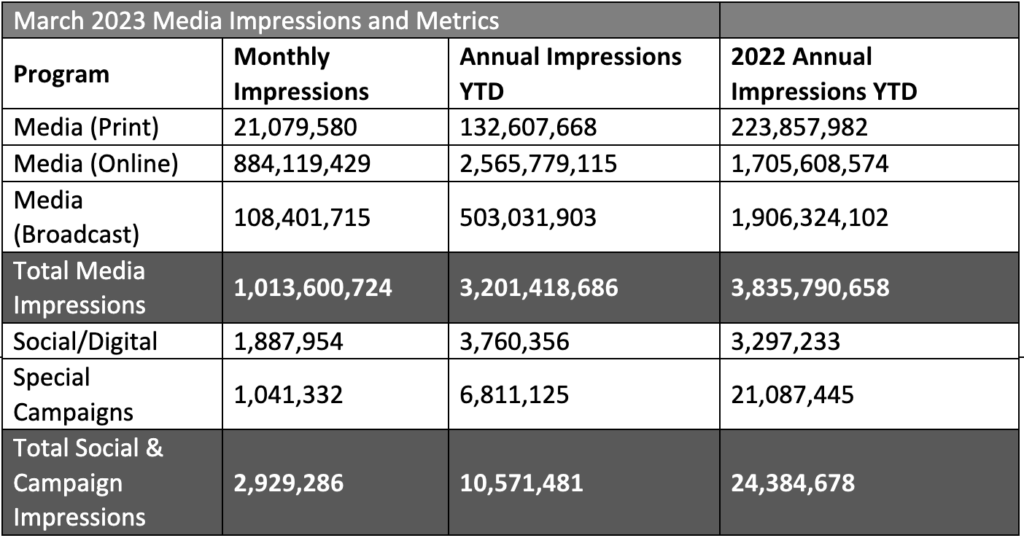

Campaign Metrics

Notable Impressions Highlights:

- March

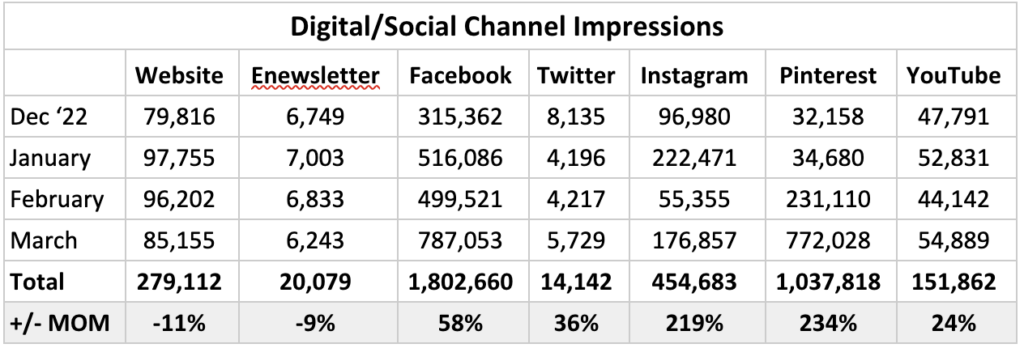

- While overall Impressions and Engagements remain steady/positive for for MC social channels, we are continuing to see numbers down from last year’s digital ads, which were a huge contributor to Impressions and Clicks to the website. Despite shifts in budget, targeting and creative, we were unable to meet the same impressions we saw last year.

- This is likely contributed to increasing competition: The PPC (Pay Per Click) advertising landscape has become increasingly competitive as more businesses conintue to shift/invest in digital ads.

- As we move into new campaigns, we’ll continue to test and optimize digital ads to better understand whether to continue or shift budgets to better performing tactics.

- Despite the decline in digital ads YOY, we are seeing tremendous performance on owned social platforms, specifically Pinterest and Instagram Impressions and Engagements, due to paid spend allocations.

- While overall Impressions and Engagements remain steady/positive for for MC social channels, we are continuing to see numbers down from last year’s digital ads, which were a huge contributor to Impressions and Clicks to the website. Despite shifts in budget, targeting and creative, we were unable to meet the same impressions we saw last year.

| *Youtube Engagament metrics have changed. Digital metrics are constantly evolving, so we created our own updated Engagement metrics (comments + shares + likes + dislikes + subscribers lost + subscribers gained) |

Special Campaign Impressions

Includes paid promotions, partnerships and advertising activities.

Previous Months Highlights

February

- Overall impressions from the MC social channels dipped compared to last month but remain consistent with results YOY.

- We shifted budget from Instagram and Facebook to Pinterest, which is reflected in the dramatic increase in engagements and impressions.

- Due to the inclusion of the “Feed Your Immune System with Soup” giveaway in the enewsletter, we saw a 77% increase in clicks. 28% of the total clicks were to the Facebook post, followed by the FYIS Exclusive Recipe Card Download.

- Pinterest impressions and engagements also saw an incredible spike due to reallocation of paid spend on this channel.

- Digital ad results are up from January, but continue to underperform compared to 2021 due to an increase in cost per impression and competition. We’re continuing to test and evaluate updates to help optimize throughout the rest of the campaign – and future campaigns.

January

- The relaunch of this year’s FYIS campaign resulted in an influx of impressions and engagments across social channels, in particular Facebook (+64% increase in Impressions and 100% increase in Engagements).

- The FYIS kick-off eblast also prompted hundreds more clicks than the month prior, driving users to the FYIS landing page.

- While social impressions and engagements are tracking YOY, digital ad impressions are down compared to January 2022. This could be due to a lower ad budget this year, ad fatigue (3rd year running) and/or audience targeting changes. We are testing and evaluating ad updates to optimize and maximize our impact through the rest of the campaign.

Retail Tracker Report

Tracker Highlights – Period ending 03/26/2023

- Download Retail Tracker for Period ending 03/26/2023

- Download Fresh Mushroom Sales Review for Period ending 03/26/2023

- Download Mushroom Retail Performance for Period ending 02/26/2023

The Marketplace

Inflation continued a long stretch of double-digit year-over-year increases in March 2023. The University of Michigan consumer confidence index dropped to 62 — the first decline in sentiment in four months as consumers increasingly expect a recession ahead, according to its March report. Widespread concern means continued money-saving measures, especially among lower- and fixed-income households.

- The survey found that 17% say their financial situation is a little or a lot better than last year, but 42% say they are a little or a lot worse off now than last year.

- Both the share of Americans applying money-saving measures (84%) and the number of measures taken (averaging 3-4 per household) sharpened in January and February of 2023. The most popular ways to save remained buying what’s on sale (54%), cutting back on non-essentials (47%), looking for coupons (35%) and switching to store brand items (29%).

- According to IRI, 29% of Americans worked from home one or more days per week in February 2023, down from 41% in February 2022 and 47% in February 2021. As more workplaces are expecting employees to work onsite one or more days a week, the struggle for time is likely going to intensify.

- Restaurant takeout and delivery are now bigger than onsite eating occasions: 50% of U.S. households have ordered takeout in the past few weeks versus 45% who ate on premise and 19% who ordered delivery.

- However, the vast majority of meals continue to be prepared at home, at a consumer-estimated 79.3%. The average is lower among Gen Z and younger Millennials, at 76.4% and peaks among Boomers at 81.3%.

Dollars, Units and Volume Performance

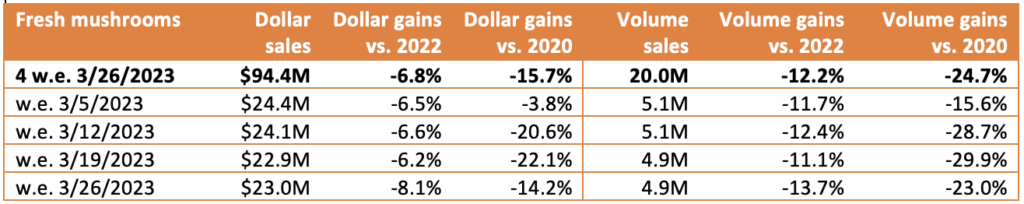

Consumers’ money-saving measure have led to sustained unit and volume pressure for departments around the store. Total food and beverage dollar sales increased 7.1% over the quad-week period, but units were down 2.6%. Fresh produce has seen negative volume comp sales for more than 20 months running. In February, deflationary conditions in fruit did prompt a slight increase in pounds, but the improvement in fruit was negated by a larger decrease in units and volume in vegetables. For the four weeks ending March 26th 2023, fresh produce dollar sales were flat (+0.2%) and fresh mushroom sales were down -6.8% year-on-year.

Fresh mushrooms also experienced unit and volume declines during the shorter and longer time periods. Year-to-date, dollars were down 4.5% versus year ago and pounds -11.3%. Dollars remained ahead of 2020 in the longer-term view, but were down 15.7% in the short-term view. Pounds are now 7.7% behind those of 2020 in the year-to-date views and 24.7% in the quad-week view versus pre-pandemic.

Weekly sales for mushrooms averaged between $22.9 million and $24.4 million, down slightly from the weekly levels of the past few months. Pound sales averaged between 4.9 and 5.1 million per week. The period-over-period sales trend fell back into the prior-year patterns (as seen on the forecasting tab) but remains well below 2019 levels at this point in terms of absolute pounds.

Inflation

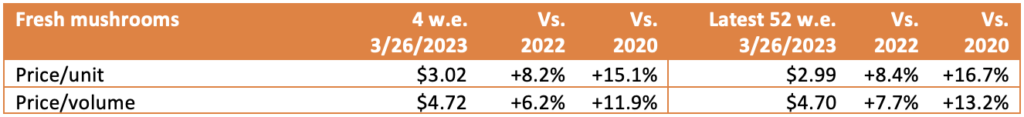

Mushroom prices per unit increased by 8.2% versus year ago in the latest quad-week period. This means the rate of inflation jumped ahead of that for total fresh vegetables (+4.3%) and total fresh produce (+0.3%).

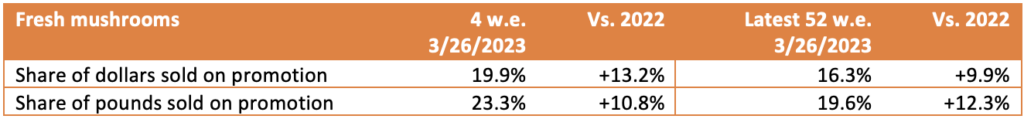

Promotional activity increased during the latest quad-week period, at 19.9% of total fresh mushroom dollars and 23.3% of total pounds sold. Promotional levels for total fresh produce as well as total food and beverages are also up a bit year-on-year, but still below the 2020 pre-pandemic levels.

Performance by segment

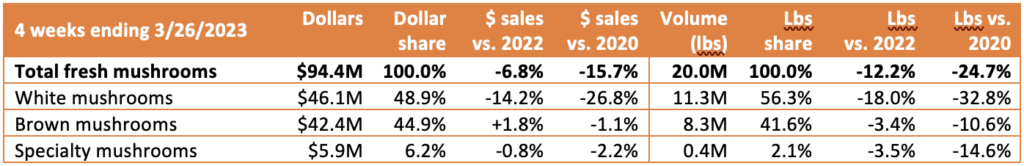

White mushrooms represented 48.9% of total fresh mushroom sales and 56.3% of pounds in the four-week period. Brown mushrooms, the combination of criminis and portabellas, fared better than white mushrooms, though both showed volume pressure.

Additional observations:

- Package size: Eight-ounce packages are, by far, the biggest seller and is outperforming 16 ounces in growth.

- Organic vs. conventional: Organic mushrooms made up 10.6% of pounds but far outperformed conventional mushrooms in performance in dollars, units and volume.

- Cut/prepared versus whole mushrooms: Cut or prepared mushrooms made up 47.7% of pound sales in the four-week period. Mushrooms without preparation had the better performance — perhaps a cost-saving measure on behalf of consumers.

IRI, Integrated Fresh, MULO, YTD and 4 weeks ending 03/26/2023

We collect, use and process your data according to our Privacy Policy.